It’s no secret that our gas and electricity bills tend to grow a tad larger during the festive period. Now is the time when friends and family get together, share a mince pie or two and stick on a Christmas film. With the heating on, of course.

But while energy usage inevitably increases, millions of UK residents are now expecting a far more expensive utility bill than usual. Rising wholesale gas and electricity costs, coupled with further green taxes, now mean that the average cost of gas and electric may go up by as much as £100 over the next 12 months.

Why exactly? Well, many large energy suppliers are putting the price hike down to a knock-on effect from Brexit. Raw energy is generally priced in US currency, which makes the pound’s collapse against the dollar particularly significant for large energy providers.

How can you cut down your energy bill over the festive period?

There are quite a few obvious steps you can take to cut down your energy bill over Christmas, most of which are probably common sense and best practice all year round.

If you or your family are walking around the house in a T-shirt with the heating on, it’s time to heed your father’s advice and invest in a woolly jumper. Of course, if you do decide to turn the heating on when you get home from work, make sure you turn it off once your ideal temperature has been reached. Keep doors and windows closed to keep the warmth in. A draft excluder always helps.

The same goes for lights – switch them off when you leave a room! Energy saving bulbs are well worth the investment and can cut down on cost over the course of months and years.

As for Christmas lights, perhaps it’s best to set a limit for when you turn them on each evening. A few hours here and there is certainly better for your budget than leaving them running all night long, which can also be a major safety hazard.

Evolution Money wishes you a very Merry Christmas, and a Happy New Year!

Credit cards have been the norm in the UK for a while now – since 1966 in fact, when Barclays first introduced their inaugural Barclaycard to the masses. It quickly proved popular with the public and the credit card network has been expanding ever since.

Fifty years on, over half of British adults own a credit card, but now our concept of credit, and indeed money, seems to be evolving yet again. And we’re not just talking about contactless payment.

Several consumer spending experts, including current chief executive of Barclaycard, Amer Sajed, have recently been talking about the gradual demise of the traditional plastic card in favour of seamless payments and wearable technology.

No doubt that future generations will have little practical use for coins, cash or cards; so, what will payment methods look like in 50 years?

Wearable technology

One very interesting prospect is the advances in wearable technology and how this might feed into our daily routines.

Barclaycard themselves have already developed prototype rings, bracelets and keychains which all contain a microchip that allow the wearer to make a payment with a simple swipe. It’s a novel idea for a few reasons, especially when you consider that it’s a lot harder to lose a ring or a sturdy bracelet compared with a wallet or purse.

Even though these items are currently little more than display models, it’s exciting to think that such technology is already well on the way to being introduced.

The immediate future

For the time being, it’s unlikely that credit cards will go out of fashion anytime soon; but the question of whether they will eventually become obsolete is certainly more when than if.

In fact, at the rate which digital technology is currently developing, it wouldn’t be a surprise to find the shift happens a lot sooner than we think.

Manchester-based secured loan provider Evolution Money has been ranked 29th on this year’s annual Sunday Times Virgin Fast Track 100 list.

Published annually since 1997, the Sunday Times Fast Track 100 ranks Britain’s private companies with the fastest-growing sales and provides a definitive league table of companies in the UK by their rate of growth.

Founded in 2011, Evolution Money has seen a substantial 90% increase in sales over the past three years. Having moved to a new office space on Portland Street, the firm now employs over 100 people and has set its sights on matching that growth over the coming years.

Steve Brilus, CEO of Evolution Money, said of the announcement: “Evolution Money are delighted to have been featured in the most recent Sunday Times edition Annual Virgin Fast Track 100, as being the 29th fastest growing private company in the UK.

“Clearly we are extremely pleased to have achieved this and we are fully appreciative of the role all of our staff, investors and customers have played. We are looking forward to continued strong growth over the next three years and beyond.”

In order to qualify for inclusion in the Fast Track 100 list, companies have to be registered in the UK and be independent, unquoted and ultimate holding companies. Sales growth is measured by compound annual growth rate (CAGR) over the last three financial years.

Evolution Money forms part of Darwin Loan Solutions, alongside its sister company Progressive Money.

With another Black Friday just past, we take a look at the origins of this relatively new tradition and how it has become an ingrained marker for the start of our festive splurging.

The concept was first introduced by American retailers keen to capitalise on the Thanksgiving holiday, a time when many people are off work and looking to shop for presents in the build up to Christmas. Big chains like Walmart and online retailers such as Amazon started the trend, which has continued to snowball every year for the past decade.

Having gradually made its way across the pond, the Black Friday tradition has well and truly set up stall in the UK. This day has once again shown that more and more retailers are embracing the idea, but are extending the discounts for the entire weekend rather than just a single day.

Black Friday goes digital

However, if this year has taught us anything it’s that there’s beginning to be a slight shift in attitude, with less brawling in the department store aisles and more online bargains popping up across the web.

In an increasingly digital world where people can now browse and buy items within a few clicks on their mobile, perhaps future Black Fridays will see retailers investing more in their online presence and less on front door security.

A classic marketing ploy

Don’t forget that Black Friday is designed by retailers for retailers, particularly those looking to sell more electronic goods like TVs, laptops and video game consoles.

It’s unlikely that customers will keep tabs on the sale of electronic goods at other times of the year, which means we are left to assume that the Black Friday deals are by far the best out there. Not necessarily. Often there’s not too much difference in price, if any.

So, if you feel like you’ve missed out on the best bargains, or if you’re planning on rushing out to the shops next year, make sure you do your research and don’t spend for the sake of it.

Cast your mind back to 1996.

Dolly the sheep is the first mammal to be cloned. Prince Charles and Princess Diana announce their divorce. England host the European Football Championships and, of course, the lads from Take That went their separate ways for the first time.

In London, the average worker earned approximately £22,000 per year. Prices were relatively steady in the housing market following the recession in 2008, and the average house cost around £79,000 – four times a person’s annual salary.

How times have changed

Fast forward to 2016 and things are significantly different. The average house price now stands at a whopping £488,908, a 518% increase from 1996, and first-time buyers can expect to pay a deposit of £96,000.

Perhaps even more shocking is the correlation between the house price increase and the average wage increase. A person working in the capital today earns approximately £36,000, which is an increase of just 66% from 1996. Compare that to the 518% increase in house prices and it’s easy to see the disparity in affordability.

‘Generation Rent’

Unsurprisingly, such a large rate of inflation over the past 20 years has impacted heavily on the city’s residents. In 2001, figures show that just 15% of Londoners rented their property, and the likelihood was that after a few years you’d be able to save up enough to afford a small flat.

These days, approximately one in three of the capital’s residents rents, with many believing that purchasing a house in the capital is getting further and further out of reach.

This has had a clear impact on London’s demographic: there is still a large influx of young professionals, but there are now more and more people in their 30s and 40s choosing to leave the capital in order to secure a more affordable property.

How long the prices can keep rising for, only time will tell. It’s certainly a good time for those residents of London who have managed to pay off most, if not all, of their mortgage.

With just under six weeks to go until the big day, it’s safe to say that the festive season is now well and truly upon us!

And despite our best intentions to put away enough money to cover all the extra expenses – presents, food, drink, decorations, tree and turkey – it’s really difficult to anticipate the total cost, particularly if you’re catering to a fairly large family.

According to international internet-based market research firm YouGov, the average British household will spend a whopping £796 on Christmas this year. That’s a lot of mince pies!

Considering a Christmas loan?

It’s no surprise that we hear from so many people around this time of year who are in need of a little extra cash during the Christmas holidays and as we enter the new year.

If funds are tight, a secured Christmas loan through Evolution Money could prove to be an excellent solution. Our loans are tailor-made to suit your personal requirements and start at £1,000. Even if you don’t have a spotless credit history, our secured loan experts take into account your whole financial situation before making a decision.

If you’re worried about your spending this Christmas then there are plenty of things to keep your bank balance in check. Have a read of this article we recently put together for some quality saving tips.

Remember the old saying: when America sneezes, the rest of the world catches a cold.

Well, with Donald Trump now due to take his seat in the White House this coming January, the global economy has its tissues ready for a period of economic and financial uncertainty.

It remains to be seen how the relationship and exchange rate between the US and Britain will be affected in the long run – whether Trump seeks to make good on the ‘special relationship’ he’s spoken about, or maintain his stance against American free-trade policies.

But in similar circumstances to the UK’s decision to leave the EU earlier this year, we’ve already seen the value of the pound fluctuating in response to this week’s election results.

Planning a trip to the US soon?

Sterling is currently performing strongly against the dollar, so if you’re planning a trip to the US in the near future then now could be a prime time to get your pounds changed into dollars.

The same goes for holidaymakers who are planning a trip to Mexico in the near future. The pound has strengthened by nearly 10% against the Mexican peso in the past few days, so getting your money exchanged sooner rather than later looks like a good option.

If you’re keen to get the best value for your money, shop around for the best rates and make sure you do so in plenty of time. Leaving currency exchange until the last minute (such as at the airport) is a surefire way to lose value for your money.

For many families in Britain, the prospect of Christmas goes beyond spending quality time with family; it’s also very expensive.

When you consider the accumulative cost of food, drinks, cards and decorations, it’s easy to see why many people quickly find themselves in debt by the turn of the new year. That’s not to mention the price of those ‘must-have’ presents, which seems to be on the rise every year.

Not to worry – Evolution Money is here to help!

The words ‘festive’ and ‘frugal’ are rarely used in the same sentence, but that’s not to say it’s impossible to enjoy the benefits of a budgeted Christmas. Here are our top five tips to save yourself money throughout the festive period…

-

Start saving from Halloween (or before!)

Those who rely solely on December’s payslip to fund their entire Christmas splurge are definitely asking for trouble.

If you want to go all out without sacrificing too many beloved frills then it always pays to get ahead with your Christmas shopping. Buy and stash what you can in November (or even October) in order to split the cost between two or three pay packets.

-

Agree your limits

As the conversation with friends, family and work colleagues turns towards the upcoming Christmas break, start planting the seed of expectation. For example, many couples with children choose to operate a ‘kids only’ rule – or at least set a fairly modest limit to spend on each other.

Secret Santa doesn’t have to be the sole preserve of the workplace either; if you’re lucky enough to have a sizeable group of friends then this can cut down the cost of getting gifts for everyone. And rather than picking up a bog-standard £20 book from the Waterstones bestseller list, get creative with £5!

Remember, it really is the thought that counts.

-

Gather your vouchers

Thinking of a perfect time to use all those Tesco Clubcard or Sainsbury’s Nectar points that you’ve accrued throughout the year? Christmas is it.

For many loyalty schemes, it pays off to convert your points into vouchers first instead of simply cashing them all in at the till in one go. These vouchers are ideal to compensate for the extra money that every family is likely to spend on all that lovely food and drink.

-

Choose your supermarket wisely

While you may not think twice about shopping at Tesco, Asda or Sainsbury’s for the rest of the year, have you ever stepped foot into Lidl or Aldi? For quality fruit, veg and meat produce, the price difference can be quite remarkable. That includes turkey!

Although all supermarkets will literally be teeming with special offers in the build up to Christmas, it’s probably best off to give Waitrose or M&S a miss if you’re looking to keep your shopping bill down.

-

The end of year clearout

While you’re already up in the loft pulling down bags full of tinsel and old decorations, take note of what items you may be prepared to part with: clothes, electronics equipment, that old telescope that hasn’t been used since 2006.

It’s no secret that websites like eBay are a prime market for selling on your unwanted goods. Once you get into the habit of uploading your listings (which can now be done quickly on your mobile phone) it could even become a fairly regular source of extra cash.

Contrary to popular belief, it seems that the British economy isn’t performing too badly since the results of the EU referendum were announced back in June.

In fact, official figures released this week show that our economy is growing at a faster rate than many experts had predicted at this stage of the year. Third quarter growth currently stands at +0.5%, nearly double the +0.3% majority forecast.

Which industries are contributing to this growth?

By far the most dominant sector, the services sector – which includes transport, storage and communications – grew by +0.8% in the third quarter.

However, this is largely isolated growth that compensates for the fact that nearly all other major sectors shrank in Q3. As expected, construction fell sharply by -1.4%as we enter the winter season, while manufacturing and agriculture also contracted.

Although no official figures have been released on consumer spending, it’s highly likely that incredibly low interest rates and a weakened pound went some way to encourage overseas spending and investment for UK goods and services.

So, was Brexit the right call?

It’s still far too early to tell. Both ‘Leave’ and ‘Remain’ voters will argue that these findings support their respective points of view.

Of course, Brexit supporters are likely to view these figures as a sign that any warnings about a potential economic downturn were largely unfounded, and that Britain is in fact, benefitting from the decision to leave the EU.

However, those who voted to remain in the EU would argue that it is the drastic action taken by the Bank of England to encourage spending that has salvaged economic growth – and that any promises of sustained growth will soon be dampened as we enter 2017.

For the time being, both opinions are somewhat speculative and, given the fact that many economic experts failed to predict the current level of growth, we still cannot be sure of either the long-term or the short-term impact economic consequences of the Brexit vote.

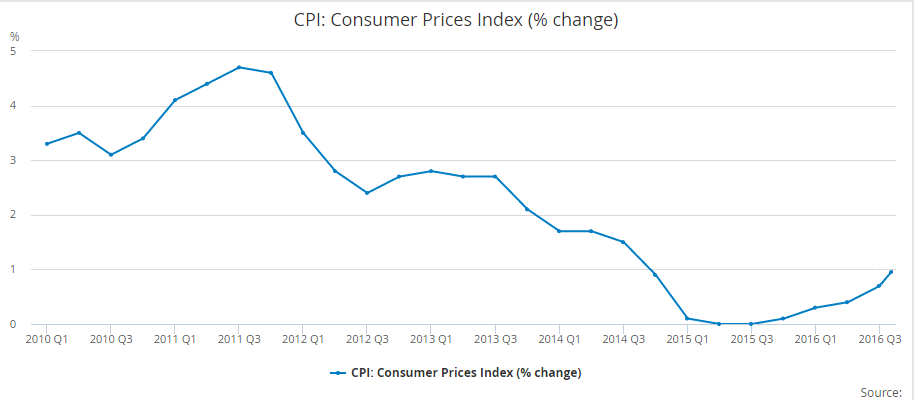

UK inflation rose to 1% in September, up from the 0.6% rate reported in August. The figures, released this week by the Office of National Statistics (ONS), also show that we’re currently at our highest annual rate of inflation since 2014.

Inflation explained

The ONS measures inflation using the Consumer Price Index (CPI), which is basically the rate at which the average shopping basket has increased or decreased over the past year. This basket includes goods and services such as food, housing, clothing, transportation, education and medical care, to name a few.

Right now, the cost of the average shopping basket is rising at a faster rate than we’ve seen in recent years. But bear in mind that, historically, our current level of inflation remains very low, especially when compared to the heights of 5% in 2011. This could indicate there’s still room for inflation to increase further in the coming year.

The below graph shows the trend of UK inflation over the past six years.

What exactly is causing the current rise?

If we take a closer look at our average shopping basket, there are a few notable contributors. Clothing and footwear prices have jumped up, as is the norm around the winter months, while the cost of fuel, hotels and restaurants has also increased. Governor of the Bank of England, Mark Carney, predicts food prices will soon rise too.

Experts say that the falling value of the pound – down by 18% against the dollar since Brexit – hasn’t had a major impact on inflation yet, though it is likely that this impact will push prices up further before too long.

Unfortunately, they also predict that poorer families will be hit hardest by the rise, due mainly to the fact that benefits are frozen at the moment and will not rise in line with CPI. As a result, these families will lose a bigger portion of their disposable income, as much as £100 per year according to the Institute for Fiscal Studies.

Representative 28.96% APRC (Variable)

For a typical loan of £26,600 over 180 months with a variable interest rate of 19.56% per annum, your monthly repayments would be £484.00. This includes a Product Fee of £2,660.00 (10% of the loan amount) and a Lending Fee* of £763.00, bringing the total repayable amount to £87,030.00. Annual Interest Rates range between 11.7% to 46.5% (variable). Maximum 50.00% APRC. *Lending Fee varies by country: England & Wales £763, Scotland £1,051, Northern Ireland: £1,736.

Think carefully before securing debts against your home may be repossessed if you do not keep up repayments on your mortgage or any other loan secured against it. If you are thinking of consolidating existing borrowing, you should be aware that you may be extending the terms of the debt and increasing the total amount you repay.