With the summer holidays now in full swing, no doubt you’ve been enjoying some extra time with the kids, and plying their free time with as many activities (and chores!) as possible.

For parents who like to plan ahead as much as possible, thoughts will soon turn to the new school year, only a month or so away. We know all too well that the cost of sending your child into the next year at school can soon rack up, especially if you’ve more than one little darling in your ranks. But while certain essentials, like a new pair of shoes, are obviously better-bought brand new, there are plenty of bits and bobs that you can pick up second-hand for a fraction of the retail price.

A good idea would be taking a full inventory of your requirements before starting the big push, as this will allow you to get a clearer view of where you could potentially save a few pennies. Here’s a choice handful of our best back-to-school bargain tips…

Textbooks

With each new school year comes a fresh curriculum, and a fresh set of textbook requirements. The total cost of that book list can seem a tad daunting, particularly if your child has reached GCSE level and beyond.

Scouting around on online directories like BookFinder, or even Amazon, which cleverly compile a comprehensive list of used textbooks from a wide range of online vendors. Just make sure you’re getting the correct edition of the title in question, and you’re good to go!

Laptops

Whether completing assignments or coursework, or making regular use of interactive revision tools, a good quality laptop or PC is now absolutely essential for the 21st-century high school student.

Fortunately, there’s more choice than ever when hunting down the best bang for your buck, providing you know what to look for in a solid spec. You won’t need anything higher than an i3 (or equivalent) processor, 250GB hard drive and 4GB of RAM, which will set you back somewhere around the £200-300 mark.

Musical instruments

Got a keen violinist, trumpeter or, heaven forbid, drummer in the household? Before you go forking out top dollar on a brand new instrument, it’s well worth checking any local classifieds and notice boards to see what’s available.

Even if it means replacing a few strings or two, chances are you’ll be able to pick up something decent for a fraction of the price, especially if your child is still at a fairly beginner level.

PE kit

Any parent will know that sports gear is one of the main back-to-school expenses that they’re likely to face each year. As with school shoes, it makes sense to have a good quality pair of all-purpose trainers that your child can use for PE, but beyond that, you should be able to pick up a few bargains when scouting around for shorts or shin pads or a second-hand tennis racquet.

Before you head into your nearest sports megastore, why not get the feelers out on social media to see if any friends have any unwanted items or scout around local thrift shops and discount stores to see what you can find at a good price.

In many countries, cities and marketplaces dotted all over the planet, haggling is a way of life. No doubt most of us will have been caught up in the excitement of haggling at some point, probably on holiday.

The rudimentary process of buying and selling is less of a soulless transaction in these places, and more of a ballet that has been going on for centuries. There’s no danger of looking cheap for wanting to get a fair price for something, particularly if you think it’s far more expensive than what it should be. In fact, if you choose not to haggle in countries with ingrained haggling tendencies then it’s almost certain that you’re going get ripped off. It’s a necessary game that people must play, and enjoy.

But not so much in the UK, right? Think of the way that any major supermarket operates and you might say it’s indicative of our way of life. We now rely on fast-paced services that require as little human interaction as possible. We’ve replaced humans on the till with optimised robots who almost rush you into gathering your bags and change, and leaving the shop.

The very idea that haggling could become a part of our day-to-day life seems more unlikely now than ever before. We’d argue otherwise.

Location, location, location

Okay, so while haggling over the price of a cheese and onion sandwich in Tesco isn’t likely to get you very far, there are plenty of independent shops, butchers, bakers, grocers etc. where you can strike a deal with the proprietor, particularly if you’re looking to buy several items.

In this sense, twenty-first-century life has been built on convenience in favour of best value for money, or quality. By seeking out the more informal shopping atmosphere that tends to be found in an independent shop, it’s far more natural to engage the shopkeeper in conversation. If you find an item with a slight issue, a shirt with a button missing or a cushion with a slight mark, then it’s likely you can talk your way into saving a few pounds.

The online haggler

If you thought the art of haggling would soon bite the dust in the digital age, think again. The Internet has afforded shrewd shoppers with more opportunities to sniff out a deal.

Live web chats are a great way to interact one-on-one with a member of staff and ask for discount codes, promotional offers and free delivery. Certain social media platforms like Twitter also allow people to broadcast their views on a particular product or customer service experience to the general public, which can often prod the business into getting in touch with the customer with a discount or some sort of freebie.

Point out your loyalty

As a customer who spends money regularly with a certain business, it’s only fair to expect some recognition for your ongoing loyalty. Fortunately, many businesses do make efforts to reward their regulars in some way, even if you have to ask for it.

For instance, the next time you’re in the market to upgrade your mobile phone then it’s worth pointing out how long you’ve been on your contract for. This could easily land you a discount, a better tariff or more 3G data each month.

We have all been told the importance of a good night’s sleep, though there are a whole host of reasons that may prevent us from sufficiently recharging our batteries when we hit the pillow each night.

According to the latest Great British Sleep Survey, most people in the UK are kept awake by their own stresses and worries about what happened today and what they’ve got on tomorrow. And although there are common physical factors such as noise, bodily discomfort and needing to make regular trips to the toilet, it seems that psychological stress is the most prevalent cause of sleeplessness.

The fact is that poor sleeping habits affect every aspect of our daily lives, and we tend to feel the impact most during the following day, both physically and emotionally. That’s why regular sleeping habits are absolutely essential to secure a healthy lifestyle routine.

With this in mind, let’s take a quick look at some expert tips for getting a better night’s sleep… and no, we don’t just mean counting sheep.

Exercise

We often think of exercise in terms of its physical benefits, but the psychological plus points are just as important, if not more so. The energy we generate within our bodies by eating food throughout the day needs to be regularly burned, not just to prevent gaining weight, but also to make us more mentally ready for bed.

You don’t need to go too deep into the physiological science behind this to realise that building up a sweat as part of an hour’s daily exercise is often more than enough to ensure we’ll be reaching the Land of Nod sooner rather than later.

Evaluate your mattress

They say the two most important possessions you can have in life are a good mattress and good pair of shoes, because if you’re not in one, you’re in the other. Maintaining the quality of your mattress is so important to prevent common ailments like back ache, which in turn can severely affect the quality of your sleep each night.

If you find yourself tossing or turning just to find a comfortable spot where you’re not necessarily being poked by the odd spring or two, it may be time to get down to your local bed shop.

A medium to firm mattress is more advisable than a soft mattress with little support – and it’s an investment that can work wonders for your sleep pattern.

Cement your own bedtime ritual

First of all, it’s really important to set yourself a time that you turn the lights off each night and get into bed. Your mind will eventually become conditioned to the action of turning off the lights, and the challenge of falling asleep will become easier and easier.

However, it pays to think about what you’re doing beforehand too. People have a tendency these days to be glued to their smartphone or tablet screen even when they’re lying in bed. By disconnecting earlier in the evening, an hour before you plan to go to sleep for instance, and perhaps spending that time reading a chapter or two of a good book, your brain will feel more ready to hit the hay than it would otherwise.

Many of us find it challenging enough to get out of bed on the right side each morning, but really it’s what we do as soon as we’ve opened the curtains that can have a huge impact on our attitude towards the day ahead.

If you’re looking to squeeze every bit of productivity out of your waking hours, it’s well worth genning up on this list of morning hacks, each designed to enhance your daily routine from the first ring of your alarm clock. Even if you decide to commit to one or two of these habits, that might still be enough to improve your standard morning experience. Heaven forbid, you may even find yourself looking forward to it.

Let’s see which ones might work for you…

1. Prepare your breakfast the night before

More often than not, one of the main issues that comes with an ineffective morning routine is the tendency to skip breakfast – our most important meal of the day.

By cutting up fruit, preparing plates and making sure your favourite cup is ready to go the night before, you’re actually preparing your brain to wake up with the extra motivation of an easy, stress-free breakfast.

2. Forget the snooze button; drink water

When our alarm clock goes off, many of use have a tendency to hit the snooze button as soon as possible. In fact, sometimes it almost seems to be an innate human reflex.

Well, it doesn’t have to be. The snooze button simply isn’t conducive to making the most of your mornings, so it’s probably for the best to cut it out altogether. One trick you can try instead is to keep a glass of water on your bedside table. Taking a big swig as soon as your eyes open can help the body and mind to wake up – or, you’ll at least feel a greater need to get yourself to the bathroom.

3. Set a morning playlist

German philosopher Immanuel Kant once referred to music as the quickening art – and we’d be inclined to agree, especially in the context of a morning routine.

Setting up a playlist full of your favourite songs is a great way to apportion time to certain tasks. For example, you might say to yourself that by the time the fifth song ends I want to be dressed and ready to leave the house. Oh, and don’t forget that a little morning boogie can really help to get the blood pumping.

4. Drink your morning coffee outside

While this isn’t always advisable (especially in the UK), going outside into your garden or balcony to drink your preferred choice of warm beverage is a good habit to get into whenever the weather permits, especially in summer.

Breathing in that fresh morning air and taking a moment to observe life within your vicinity is a far more natural start to the day than immediately checking your emails first thing. You’ll have plenty of time for that throughout the day.

5. Designate a space for your phone, wallet, keys and bag

This is a biggie. There is nothing worse than not being able to find your car keys in the morning, largely because you often have nobody to blame but yourself.

That might sound a tad harsh, but all that stressing out can so easily be avoided by setting out a clear space to put the most important items of your daily inventory. This way, you’ll know exactly where to find them each and every morning before you leave the house – and it’s very likely that you’ll appreciate having made life a whole lot easier for yourself.

Love it or hate it, the weekly shop is a recurring tradition for families the world over. It also presents a key opportunity to get smart with our money, particularly if we’re looking to keep a tight rein on budget.

The good news is that there are plenty of quick tweaks that could easily save you hundreds of pounds over the course of a single year – and none of them involve missing out on your favourite bits and pieces.

Here are five easy ways to save money on your weekly food shop…

1. Choose value over convenience

When faced with the choice between supermarkets, a lot of people tend to automatically opt for the one that is closest to their house. But while this convenience is certainly a plus, it’s not always the most cost-effective.

Scout out a few different supermarkets before deciding which one offers the best value for your average weekly spend.

2. Write a list (and stick to it!)

By taking a few minutes to jot down a list of all the things you need for that week, you are far less likely to go out spending on a whim, and it will definitely cut down the time you spend rambling around the aisles.

Remember, idle browsing is the enemy of the conscientious budgeter.

3. Cash in on vouchers and coupons

Whether it’s Nectar points at Sainsbury’s or a Clubcard at Tesco, regular shoppers can benefit greatly by building up their balance of bonuses.

The trick here is to get into the habit of using your card every time you nip into the supermarket. It might take a few months of restraint before your bank of points starts building, but just remember you’re putting yourself in a good position to save further down the line.

4. Fill the pantry

How often does the idea of ‘not having anything in the cupboards’ result in getting a takeaway? Quite often, we’d say.

Make sure you’re well stocked on long-lasting items such as rice, pasta, olive oil, tinned tomatoes and the like. These should be considered essentials that enable you to whip up a quick meal whenever necessary.

5. Go big on non-branded items

The question as to whether one can actually tell a discernible difference between branded and non-branded items is a really interesting one – and likely to be rooted in our own psychology.

If you’re still adamant about a difference in quality, why not set yourself a taste test on things like ketchup or cornflakes and see whether you’d be happy putting more non-branded items in your trolley.

It’s not difficult to see why contactless cards have become so popular. Who wouldn’t prefer to pay for small purchases like coffees and train tickets with a single tap? But while £25.3bn was spent using the contactless cards last year, new figures from Financial Fraud Action UK suggest that we should be cautious when using the technology.

Contactless fraud recently grew by almost 150% in 2016 – increasing from £2.8m to £6.9m in the space of a year. This might only represent 1.1% of total card fraud, but with contactless adoption still on the rise, it’s worth knowing the risks.

In 2015 the consumer comparison website Which? discovered a flaw in contactless cards using a card-reading technology which is easy to obtain online. They were able to remotely steal details from a number of sample cards, using them to make purchases including a £3000 TV.

While a £30 limit exists on payments made in store on contactless cards, this exploit makes the limit irrelevant, as it only requires the card details which you would typically use in an online purchase.

A more immediate risk comes from the fact that many businesses process contactless payments offline, with card machines storing up a number of payments which will be processed long after the transaction. This allows fraudsters to use cards which have been cancelled, often without the victim’s knowledge, as some banks don’t inform their customers when a cancelled card has been used.

This places the onus on customers to discover and challenge fraudulent payments on their cards, which can be difficult considering the huge range of minor transactions which they are now used for.

How to avoid contactless card fraud

There are a few key steps you can take to avoid contactless fraud. While it might sound like the equivalent of wearing a tin foil hat, using a specially lined wallet could help to prevent your card from being ‘skimmed’ (having its details stolen) by scammers.

You should also be careful to never hand over your card to servers in bars, cafes and shops who may use the opportunity to run it through a skimming device while out of sight. Asking for receipts is also important, as they frequently aren’t offered to contactless users. Frequently checking your transactions will help to ensure that you are aware of any unusual transactions and that you aren’t being overcharged.

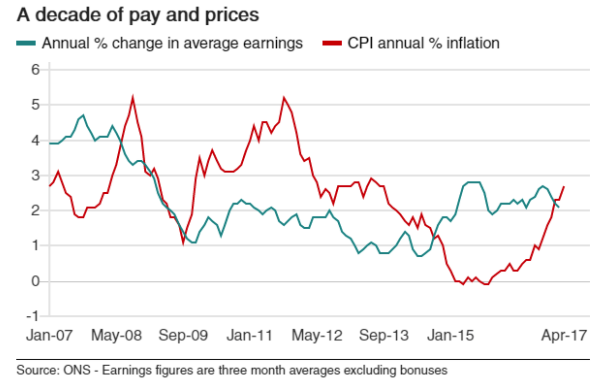

A recent national report conducted by the Office of National Statistics (ONS) has revealed that wages are increasing at a slower rate than inflation for the first time since 2014. Right now, the average salary has increased by 2.1% in the three months to March; however, inflation is up 2.3% over the same time period, creating a differential of -0.2%.

Simply put, the average cost of living is currently rising at a faster rate than real wages, which means that people now have less disposable income after paying for their weekly and monthly essentials. Experts say that the current trend can be attributed to the longer term impact of Brexit on UK households and their total budget.

The below graph is a good visualisation of the current trend, and shows the correlation between average earnings and inflation (CPI) over the last 10 years:

Unemployment lower than ever – but is it all good news?

Also this week, the ONS announced findings that the UK unemployment rate was the lowest it’s been for 42 years. Currently, there are approximately 31.95 million people in work, which works out to around 75% of 16 to 64-year olds.

It’s clear that Britain’s businesses are now hiring more employees than at any other point in recent memory; the problem is that the average job cannot be considered ‘well-paid’ in the context of our current cost of living. Again, the general thought among economists is that this trend is only temporary, and it won’t be long before real wages start rising in line with the demand for employment.

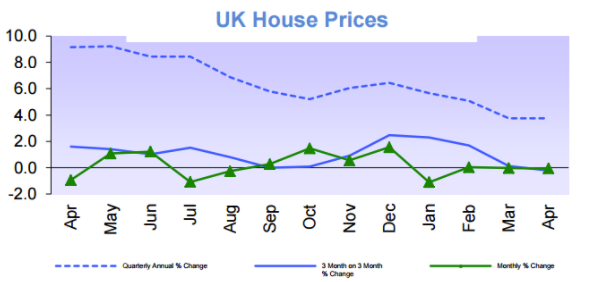

According to a recent statement released by Halifax, house prices in the three months to April 2017 were approximately 0.2% lower than in the previous quarter. That means the average house price now stands at £219,649. Although the fall may seem marginal enough, this is actually the first quarterly decline in the UK housing price index since November 2012.

The report follows another statement made by Nationwide last week that revealed house prices were, in fact, growing at a slower annual rate than at any other time during the last four years – a relatively sluggish 2.6% growth per year, to be exact.

Both reports are indicative of a general downward trend emerging in the property market in the first half of 2017:

Why are house prices stagnating?

The fall in house prices reflects the current demand for housing, which seems to have been falling in recent months due to affordability.

If you consider that until this point house prices have been consistently inflating each quarter for nearly five years, it seems that now we’ve finally reached a tipping point – albeit a modest one. Simply put, the cost of reaching the next rung on the property ladder has inflated beyond what most people can afford.

Supply is also a major factor. A recent RICS report revealed that the average stock levels on estate agents’ books is at a historic low, which means there are fewer options than ever for people looking to move.

Nevertheless, mortgage rates remain very low which, coupled with a general shortage of supply across the country, is expected to keep the housing market at a steady level over the next quarter.

The 16th of May is a very special day on the Evolution Money Calendar – it’s our birthday!

So, this time 6 years ago what was happening…? Well, our colleague James was sitting at his desk (as he is today) but back then he was very excited at the thought of us funding our very first loan, a loan for £750.

It was Monday 16th May 2011 and the business was packaging its very first loan. We had been preparing for this moment for five months and the tension was building… we packaged it, approved it and prepared it for a pre-funding review.

The file was passed to our FD who scrutinised it to within an inch of its life, before he counter-signed it and we were ready to go…

At 16:44 on Monday 16th May 2011 we hit the button and the funds were transferred and that was it, our first loan was funded and Evolution’s journey had begun…!

Fast forward 6 years and what does the business look like today?

Well, we are now a multi award winning, multi-million-pound business…

We’ve outgrown the stationery cupboard we started out in and now employ over 150 people. From that first loan for £750 we have gone on to lend a staggering £134m to over 14,000 customers. That’s certainly something worth celebrating.

One of the highlights of the last six years must be watching how people have grown with the business and seeing new people join. At Evolution Money, we truly do have a brilliant team of people. It’s testament to the business that many of the original team are still here all this time later.

Six years on, as MD, I am still as excited as I was when we funded that first loan. The building blocks have been secured for the future and the business continues to grow from strength to strength.

The future is still for us all to determine and if we work together it will be great. We must remember the founding value of our business, succinctly rolled up in one word – TRUST.

Trust that we are doing the right things every day. Trust from our investors that we are running a compliant and robust business. Trust from our customers that we interact with them in a fair and transparent way, ensuring they are at the heart of everything we do. Trust from our colleagues that we are all working together and that no one individual is more important than the team…. If we achieve this then we will continue to have a great business.

On behalf of myself and the rest of the Directors a huge THANK YOU to both our customers and our team for the journey so far and we look forward to working with you for the next 6 years…

Mat Beaver,

Managing Director

The Financial Conduct Authority (FCA) has proposed new rules which are aimed at tackling the worrying rise in long-term credit card debts, by compelling firms to encourage faster repayments, and in some cases, reducing or waiving interest charges.

What are persistent debts?

According to the FCA, persistent credit card debt affects anyone who has paid more in interest and charges than they have repaid of their borrowing over the course of 18 months. With an estimated 3.3 million people in persistent debt, their new proposals could provide a much needed source of relief.

Andrew Bailey, chief executive of the FCA, highlighted the extreme costs of persistent debt, noting that this was largely deliberate on the part of lenders ‘because these customers remain profitable, firms have few incentives to intervene.’

The new rules

The new guidelines suggest that firms should contact customers who have been in persistent debt for more than a year and a half, prompting them to make faster repayments.

Following a further period of 18 months, firms would be required to propose repayment plans to customers. Those who cannot afford to pay the balance in a reasonable period could then have interest charges reduced or cancelled. The FCA also recommends that firms use the vast amount of customer data available to them to identify those experiencing difficulties and intervene.

The proposals are now in consultation until July 3rd 2017, with the watchdog estimating that it could save customers between £3 billion and £13 billion by 2030.

In the meantime, it’s always worth weighing up every option before you take the plunge with a particular credit card or loan. If you aren’t confident that you’ll be able to pay off the amount you borrow each month, other forms of credit may be more suitable for you.

Representative 21.54% APRC (Variable)

For a typical loan of £12,000 over 60 months with a variable interest rate of 21.54% per annum, your monthly repayments would be £310.60. This includes a Product Fee of £1,200.00 (10% of the loan amount) and a Lending Fee* of £763.00, bringing the total repayable amount to £18,635.80. Annual Interest Rates range between 8.6% to 27.87% (variable). Maximum 50.00% APRC. *Lending Fee varies by country: England & Wales £763, Scotland £1,051, Northern Ireland: £1,736.

Think carefully before securing debts against your home. Your home may be repossessed if you do not keep up repayments on your mortgage or any other loan secured against it. If you are thinking of consolidating existing borrowing, you should be aware that you may be extending the terms of the debt and increasing the total amount you repay.