In the internet age, we have access to more information than ever before. However – while this technology has proved greatly beneficial – it has also led to a variety of problems. For example, ‘fake news’ is not just limited to media coverage but also spread to how we process information.

This includes how we manage our finances. Navigating this world can be challenging to begin with but there is so much misinformation about credit scores out there that we keep hearing the same myths again and again.

Hopefully, we can now put some of these falsehoods to rest while clarifying those which will have any sort of impact on your credit score.

Your credit score explained

First, let’s explain what your credit score actually is. While we’ve covered this in detail within our help and advice section, your credit score basically indicates how much of a potential risk you could be to lenders.

The higher your credit score generally is, the more responsible you will appear to these organisations. Negative elements such as missed bill payments, multiple credit cards, or county court judgements can reduce this figure and might prevent you from obtaining certain financial products.

We also have a range of hints and tips if you want to repair a poor credit score.

Top myths about credit scores

Although there’s a substantial amount of information out there related to credit scores, we continue to hear inaccuracies about what influences these figures. We’ve detailed those we hear most often below:

Every person has one credit score

False. Nobody has a single credit score or rating that is used to assess their eligibility for credit; instead, credit checks are completed at the discretion of each credit provider. This means that people can have multiple scores at any one time, depending on the individual criteria of each agency.

These credit scores vary as different agencies operate on unique scoring models. Regardless, the higher these figures are, the better financial products you should have access to.

Previous occupants of your house can affect a credit score

False. It’s a common misconception that the previous occupant of your property can impact your credit score, or that the credit history of a particular house somehow passes over to the next person who moves in.

These days, credit checks are conducted on individuals, rather than addresses. In most cases, your personal credit score does not factor in the financial situation of others, unless you have received approval for a joint credit application or are financially associated with another person.

Never borrowed money? You will have a good credit score

False. Although it’s logical to think that if you’ve never had the need to apply for credit then you must have a tight handle on your finances, this doesn’t necessarily mean you will have a good credit score.

When assessing any application for credit, most lenders are keen to see evidence that a person has borrowed money in the past and has been able to pay it back on time. Many people look to solve this issue by taking out a credit card, not because they need the extra funds, but because they can use it to build a history of well-managed credit repayments.

Bad credit lasts forever

False. Many people are worried about the future impact of their credit decisions, particularly if they have missed repayments in the past.

The good news is that credit checks are designed to be an accurate and detailed picture of a person’s current financial situation, and so the majority of lenders will only take into account credit information within the past six years.

Checking your credit report harms your credit score

False. Checking your credit report will not adversely affect your credit score. Although there are paid and free ways to do this, you can request this check as many times as you like to observe fluctuations in your score.

When lenders are assessing how much of a potential risk you are, they will take into consideration the applications for financial products left on your report. Events such as a soft credit enquiry (when credit is not investigated as part of a lending decision) or checking your credit score will not factor into this analysis.

Therefore, as long as you are not routinely applying for products in order to determine your score, you won’t be adversely affected by making regular checks.

Employers can check your credit score

False. One of the most prevalent myths about credit scores states these figures can be reviewed by an employer. This is not true and the problem likely arises from individuals using the phrases ‘credit report’ and ‘credit score’ interchangeably.

Although an employer can review your credit report, this differs from the one typically seen by lenders and is often used to indicate how financially responsible a worker is – especially so if the job requires handling large amounts of funds.

Furthermore, he or she cannot do this on a whim. If an employer seeks to review your credit report (not all employers would want to) you must give written consent.

You can be on a credit blacklist

False. There is no such thing as a credit backlist. We can assume that if such a document did exist (and you were on it) you would be banned from borrowing funds and find it extremely difficult to be removed.

If someone is turned down repeatedly for financial products, he or she might assume they are on a blacklist – which is probably how the rumour started. However, there are lots of factors which can influence how likely an application is to succeed.

If that individual worked on improving their credit score, they would soon realise that they haven’t been blacklisted by lenders at all.

When applying for a loan, mortgage, or credit card, your credit score will typically be evaluated to determine how safe a borrower you are. During the check itself, a variety of potential factors will be reviewed. These could include:

- Your name and date of birth.

- The value and length of any loans, credit cards, or mortgages taken out in that person’s name.

- The conduct of these loans. For example, highlighting if any payments were missed.

- Your history of utility bill payments, phone bill payments, and other bills.

- Your history of previous loan applications.

- Your payment profile – if there have been any late payments or if payments have been made on time.

Depending on what credit score you have, this will have a bearing on what sort of financial products you can obtain. Those with an extremely low credit score may struggle to gain access to any sort of loan – or might be required to pay higher rates.

What is a bad credit score?

When lenders are evaluating credit scores, they will do so against a scale. Although variations exist across agencies, Experian’s scale ranges between 0 and 999. Under those measurements, a score of 881 or more is classified as ‘good’. A credit score under 720 though is described as ‘poor’.

When determining these scores, certain aspects of a person’s history will have greater weighting than others. For example, according to Experian, the most important factor is an applicant’s payment history – making up around 35% of the total score.

Regardless, if your credit score falls within the ‘poor’ range, this is no cause for despair. The good news is these ratings can be improved with some hard work.

How to fix a bad credit score

The first step to fixing a poor credit score is determining where the problem lies. As mentioned earlier, this rating takes a variety of factors into account so learning which one negatively affects your score is a great step in the right direction. Therefore, before doing anything, you should request to view your credit report.

Once obtained, you should review it in detail to determine that the information is accurate.

The importance of fixing inaccuracies

Although inaccuracies might include basic errors, such as incorrect address details, reviewing this report can also identify fraudulent activities.

If someone has made an application for a loan in your name, then this could have a detrimental effect on your credit score. Although this should be reported immediately, other mistakes ought to be highlighted to the organisation which supplied the original information.

You may also choose to add a ‘notice of correction’ as a way to highlight extenuating circumstances. For example, hospitalisation preventing you from working and, therefore, causing you to miss a mortgage payment.

How else can I improve my credit score?

Once you’ve determined how accurate your credit report is, you can begin to take steps to improve it. Fortunately, they are a variety of ways you could do this:

- Paying bills on time. It sounds obvious, but this is a great way to demonstrate your trustworthiness to potential lenders.

- Resolve your debts. It is advisable to clear your debts before taking on additional finances as well as closing any unused credit cards. Clearing this may make you more attractive applicant to some lenders.

- See who you share accounts with. You might have a spotless credit history, but does your spouse? If your credit report is linked with a person who has a poor credit score, you might find it harder to obtain a good deal. In this situation, that individual could benefit by taking some of the steps mentioned here.

- Reduce the number of credit cards. Having too many cards may be seen as an inability to effectively manage your finances without resorting to multiple credit options.

- Get on the electoral register. This is important as the electoral register is one of the best ways for lenders to check/confirm your information.

- Build your credit history. Even if you have no debts, you might have a poor credit score as there is no record of responsible payment. In this situation, applying for a credit card or credit-builder loan could help rectify this.

- Seek advice from the Money Advice Service, an independent service set up to help people manage their money.

How long will it take to improve my credit score?

Sadly, there is no quick way to do this. Potentially, it might take months or even years before you improve your credit score. However, in many ways, this can be viewed as an opportunity.

Improving a credit score is a marathon, not a sprint. Much like how the best runners don’t immediately start with a challenging event, taking small steps now will likely yield more positive results in the future.

Therefore, start slow. Understand the points in your credit report and strive to improve these one at a time. Alternatively, if your debts are getting on top of you, consider professional advice or consolidating your loans into affordable monthly repayments.

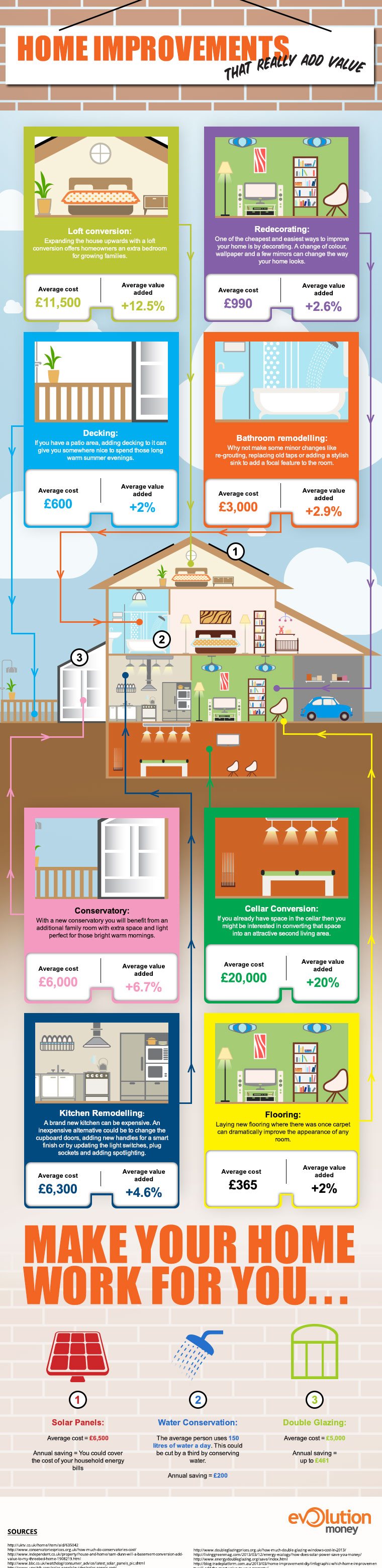

Whether you plan on selling your house in the near future – and want to set a higher asking price – or you simply need a bit of a change in your day-to-day living, there are plenty of options to consider when it comes to home improvement.

Of course, every person or family has their own distinct priorities. You may need to replace a faulty oven, create more space within the house, redecorate a particular room, or even transform the garden into a liveable space. While any increase in total market value depends on how much you choose to invest in the first place, everybody can do a few things to get the ball rolling. In this guide, we will look at some of the factors which can influence property value as well as suggest a few small tweaks which can go a long way.

How can location affect the value of my home?

First, let’s focus on something you can’t change – where your home is based. The effect of location on property values can vary depending on a number of external factors. For example, living in an area with an excellent local economy which features a good community spirit can do wonders for property prices. In a similar fashion, if a school is due to be built near you, the value of your home could increase.

One report, published in the Independent, highlighted the effects of having a supermarket on your doorstep. According to the report, living near a Waitrose could add more than £36,000 to the value of a home. In fact, being in close proximity to any major supermarket may improve property prices by approximately £22,000.

This has lead to some individuals describing this as the ‘Waitrose effect’.

In 2017, an article in the Guardian highlighted the areas of the UK where property prices were increasing. Over a 12-month period, the North West saw the greatest hikes with a seven percent gain in house values. In contrast, the value of homes in London had a regional increase of 2.5%.

Therefore, although you can’t change where your property is based, there are external factors which can affect its value. As well as spotting the addition of amenities such as a supermarket, This is Money has highlighted other factors.

For example, according to the organisation, the arrival of niche food chains – such as delicatessens – can be a sign that the local population is becoming more affluent and will have more disposable income.

Furthermore, an increasing youth population can be positive. Afterall, the publication argues, the majority of these will be young professionals who require access to transport links and local businesses. As a result, this demand will bring these organisations to the area and improve the area – increasing house prices as a result.

However, be aware that you won’t be the only one looking for these indicators. Anecdotally, there are stories of house visits turning into queues of potential buyers. As a result, these desirable properties can go for much higher than the original asking price.

Therefore, it requires plenty of foresight – and a bit of luck – to benefit from these changes.

How can I improve the value of my home?

Although location is an area you won’t have much influence over, there are lots of elements you can control. We’ve outlined most of these in our home improvement infographic but we’ve broken down the information here:

How loft conversions affect property values

A loft conversion is a large investment. On average, this can cost around £11,500. However, the benefits could be huge – adding an average 12.5% to the value of a home.

Buyers will always pay more for extra space and a loft conversion is an effective way to do this. However, in some cases, they can be difficult to implement and planning permission might also be required.

Therefore, a survey should be carried out to analyse how feasible this is before taking the plunge.

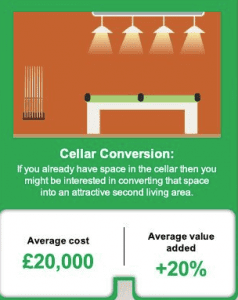

How a cellar conversion can add value to your home

If it’s too difficult to head up, maybe you can head down. If you have a large basement which is being used for storage, you might be able to convert this into an attractive living space. There is a lot of work to making this a viable option though and, on average, can cost around £20,000. However, if successful, a cellar conversion can add an average of 20% to the value of your property.

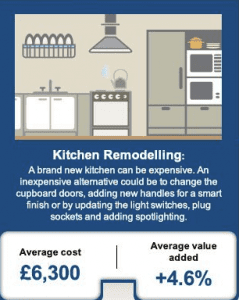

How remodelling the kitchen can increase the value of your property

Installing a brand-new kitchen is often an expensive prospect. However, a kitchen remodel could be a cheaper alternative to increasing property values. For example, changing the cupboard doors and adding new handles can give the place a smarter finish. On average, the cost of a kitchen remodel can come in at around £6,300. Yet, this could add an estimated 4.6 percent to the value of your home.

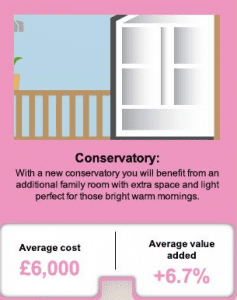

Add a conservatory to increase property value

If you’ve got the space, then a conservatory can be an excellent way to improve the value of your property. However, it is not without challenges. Planning permission might be required and you should decide whether this extension should be east or west-facing. Which direction you choose will determine if the conservatory is better suited as a breakfast room or as an evening living area.

Regardless, for an average cost of £6,000, a conservatory can improve the value of a property by an average of 6.7 percent.

Remodel the bathroom to improve property prices

The bathroom is perhaps the most important room in a home and remodelling it can be greatly beneficial to the overall value of a property. In fact, just keeping it clean and free of grime could be time well spent. Alternatively, remodelling the taps or installing a stylish sink can go a long way to making the bathroom a cheerier place.

On average, remodelling the bathroom can cost around £3,000. However, this could add an average of 2.9 percent to the overall value of your property.

Home improvements for under £1,000

We’ve dealt with some of the larger investments here but there are a variety of smaller jobs which can pay dividends. We’ve detailed some of these suggestions here.

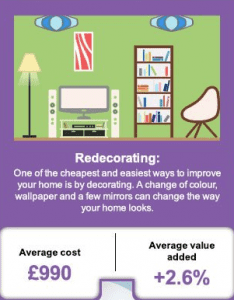

Redecorating and the effects on house values

It’s amazing what a lick of paint can do. However, don’t limit your redecorating to the inside of your home. Sprucing up the outside and tidying up the front lawn can make your property a much more attractive prospect.

Furthermore, if colours are fading, consider replacing them with a new coat of paint or wallpaper. Living areas and bedrooms should feature warm colours, hallways could benefit from neutral schemes, and bathrooms should have cool interiors.

On average, redecorating a home can cost around £990. However, it can add an average of 2.6 percent to the value of your property.

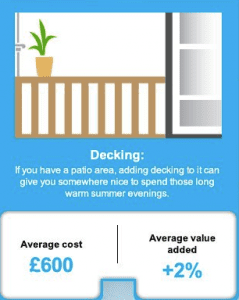

Decking can improve the value of your home

If you already have a patio area then some decking can go a long way to making it a more charming prospect. As long as you use a quality supplier and make the addition an attractive one, you could increase the value of your home as well.

For an average cost of £600, we estimate that the average value of your home could increase by around two percent.

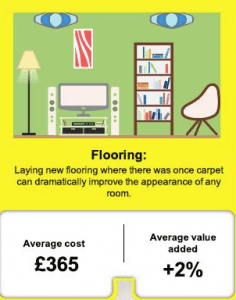

Boost property values by focusing on floors

Replacing carpets with wooden flooring can really make a difference when boosting property values. As long as this isn’t done excessively and uses quality supplies, strong and study wood can enhance the appeal of a room as well as benefit the bottom line.

In fact, spending an average of £365 on flooring could improve the average value of your home by around two percent.

How much value can my property gain?

In this guide we have looked at multiple ways you can improve the value of your home. From larger jobs to quick maintenance, the changes mentioned above should go a long way to affecting your bottom line. If you carried out all of these suggestions, we estimate the price of your home could increase by an average of 53.3% at a cost of around £48,000. Therefore, looking at 2017 average house prices, this means a typical home in the north west could gain around £83,000 in value. In contrast, a standard home in the south east may see its value increase by around £171,000.

Hidden elements which can affect property values

Although there are multiple ways to improve the value of your home, it is worth bearing in mind that there are some hidden factors which can adversely affect a property’s value. For example, these can include:

- Outdated plumbing/problems with water circulation

- Risk of subsidence

- Rude neighbours

- Damp

- Parking facilities

By bearing these in mind when conducting home improvements, we hope you won’t experience any nasty surprises!

Sources

- ‘Waitrose effect’ can ‘boost house prices by thousands of pounds’

- House prices rise 5% a year in more bad news for would-be-buyers

- Five ways to spot an up-and-coming area: The secrets of buying a property ahead of the house price curve

- UK House Price Index (HPI) for July 2017

- So How Much Do Conservatories Actually Cost

- Sam Dunn: ‘Will a basement conversion add value to my three-bed home?’

- How Much Do Double Glazing Windows Cost in 2017?

- The Evolution Money home infographic (see below)

Evolution Money are proud to announce they have won the Feefo Gold Service award for 2018.

This independent award recognises businesses who deliver exceptional experiences rated and reviews from real customers.

Created by Feefo, Trusted service is awarded only to those companies that meet the high standard, based on the number genuine reviews collected and average rating received. This accreditation remains unique, as it is based purely on the interactions with verified customers. All reviews are verified as genuine, the accreditation is a true reflection of a business’ commitment to outstanding service.

Lynne Hardwick Head of Marketing said “It’s a real honour to be recognised for delivering exceptional service for our customers. We’ve been working hard to ensure our customers receive the best possible service. We’re looking forward to another successful year ahead”.

Speaking on this year’s award, Andrew Mabbutt, CEO at Feefo, commented: ‘The Trusted Service award has always been about recognising those companies that go the extra mile. Once again, we have seen many incredible businesses using Feefo to its full potential, to provide truly memorable experiences for their customers – and rightly being awarded with our most prestigious accreditation. I look forward to the continual success of the businesses that work in partnership with Feefo throughout 2018.’

To achieve this coveted Gold Trusted Service 2018 award, Evolution Money collected at least 50 reviews and achieved a Feefo service rating of 4.5 and 5.0. from January to December 2017.

Evolution Money are honoured to be receive this accredited award and are committed to continuing in working hard to deliver outstanding levels of customer service in the future.

Representative 22.93% APRC variable.

For a typical loan of £26,600 over 180 months with a variable interest rate of 19.56% per annum, your monthly repayments would be £484.00. This includes a Product Fee of £2,660.00 (10% of the loan amount) and a Lending Fee* of £763.00, bringing the total repayable amount to £87,030.00. Annual Interest Rates range between 11.7% to 46.5% (variable). Maximum 50.00% APRC. *Lending Fee varies by country: England & Wales £763, Scotland £1,051, Northern Ireland: £1,736.

Think carefully before securing debts against your home may be repossessed if you do not keep up repayments on your mortgage or any other loan secured against it. If you are thinking of consolidating existing borrowing, you should be aware that you may be extending the terms of the debt and increasing the total amount you repay.