We’ve investigated what exterior features can make your home more attractive to prospective buyers, and even increase its value.

We all know that even if we’re not looking to buy a property, we still form an opinion of it from the moment we see it. But how much does that first impression impact our overall decision to buy a property, and how much we’re prepared to pay for it?

To find out, we asked 2,000 UK residents just how much ‘kerb appeal’ impacts their decision when they’re house hunting.

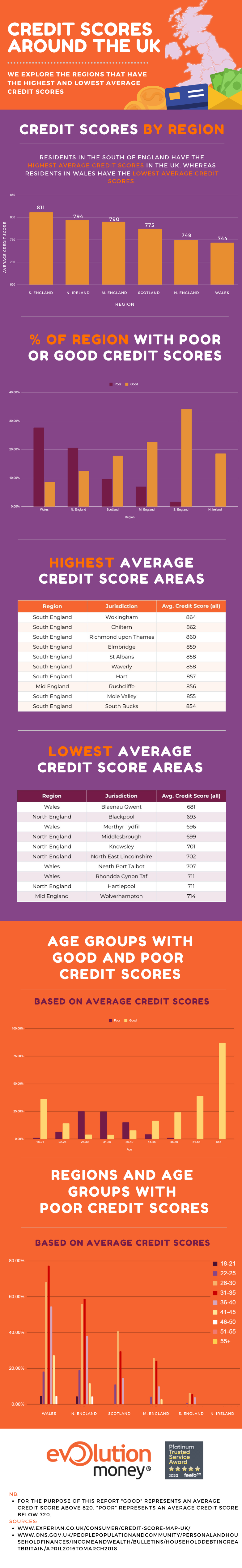

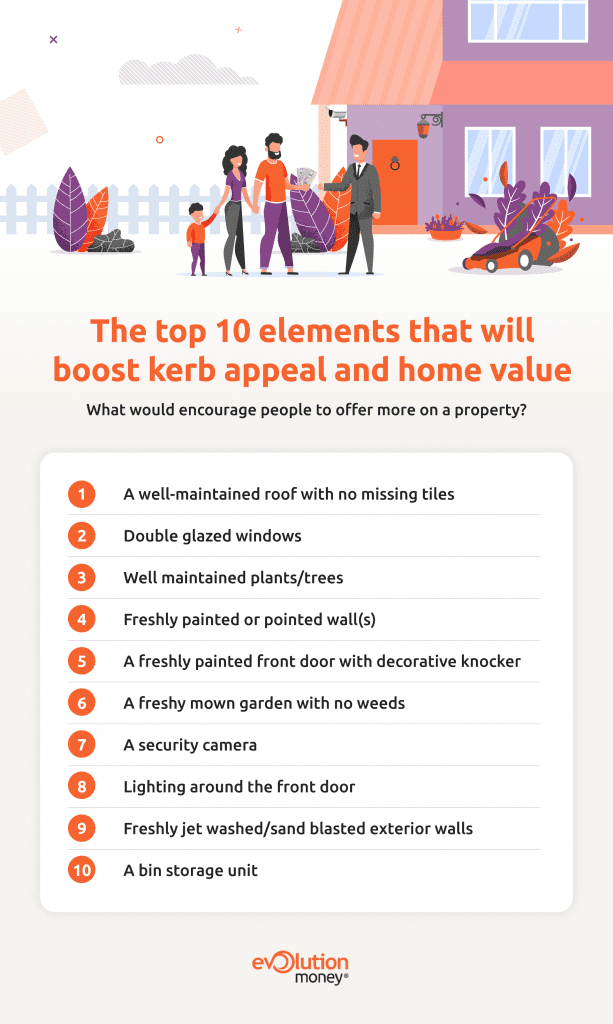

Our research reveals that most people (93%) pass judgement on a property based on purely on how it looks from the outside, and the exterior appearance of a home has the power to affect its value too, with three in ten (30%) happy to pay an extra £5,000 or more for a home with a well-maintained exterior. But which elements are particularly persuasive when it comes to generating that extra cash?

Double glazed windows (37%), a well-maintained roof with no missing tiles (37%) and well-maintained plants or trees (25%) were the top three contenders when it came to encouraging a higher offer for property.

While these can be expensive to install or fix there are several cheaper ways to make a property more appealing to perspective buyers:

-

- A freshly painted door is inexpensive and encourages one in five (19%) people to offer more money

- A neat lawn (19%)

- Freshly jet washed walls (13%) or path (12%)

- A clean car in the driveway (10%) are also key to consider when trying to achieve maximum ‘kerb appeal’ and property value.

Interestingly, it is the younger generation (18-24s year-olds) that are most comfortable offering more money for a home with a well-maintained exterior, and it is also this generation that value non-permanent or low-cost features too such as a clean car on the driveway (14%), a house name (11%) and a bespoke house number next to the front door (11%).

The outside appearance of a property also has the power to put potential buyers off buying it altogether and even lower its value too. Crack(s) in the exterior walls (64%), damaged windows (61%) and a roof with missing or uneven tiling (57%) were all identified as key elements that take away from a property’s ‘kerb appeal’.

In addition to these, an unmown lawn (26%), visible rubbish bins (21%), a very brightly coloured front door (19%), a lack of outside lighting (9%) and washing hanging outside (7%) also have an adverse effect on the first impression of a property.

Again, it would appear as though the younger generations are more guilty of judging a property by how it looks from the outside, with 98% of 18–24-year-olds admitting to deciding if they like a house before they’ve even stepped inside it.

We spoke to Craig Bray, Divisional Director at Yopa estate agents about our research findings and he said: “Would-be sellers can really boost the value of their property with some simple, tactful renovations.

“At Yopa we estimate that simply improving your property’s ‘kerb appeal’ with a freshly painted exterior, clean windows, clear gutters, a tidy driveway and a freshly painted front door can boost the value of a property by up to 10%.

“First impressions count, and the outside of your property is the first thing potential buyers will see, both when browsing online and in person at a viewing.”

The ONS quoted the average UK house price as being £251,000 in April 2021, which means that according to Craig at Yopa, a well-presented property could achieve an additional £25,100 in value.

If you’re a homeowner who is looking to improve the ‘kerb appeal’ of your property, then our Homeowner Loan could provide you the cash you need to make those all-important changes.

Don’t forget, we’re here to help! We have listed some frequently raised questions and answers which may help you when you’re considering a loan provided through Evolution Money.

Alternatively, you could contact us directly or use our no-obligation application form to get an idea from an adviser of what loan could be available to you.

Evolution Money surveyed 2,000 UK adults in August 2021.

Evolution Money, a secured loans provider based in Manchester, have been nominated as a finalist in the MEN Business of The Year Awards.

The announcement follows the recent news of a three-year, £100m senior debt facility with NatWest, continuing a strong year for the company.

Steve Brilus, CEO of Evolution Money, said: “We’re honoured to be nominated in the prestigious MEN Business of The Year Awards. As a Manchester founded company, it is a privilege to be a finalist alongside so many other fantastic local businesses.

Evolution Money has had an incredibly successful 2018 and 2019, but none of our achievements would have been possible without the valued contribution of each member of the Evolution family.”

Steve added: “At Evolution Money, we are always striving to evolve and innovate in order to support our future growth and on-going commercial success. Our focus will always be our customers, ensuring responsible lending is at the heart of everything we do.”

Award-winning Evolution Money, is part of the Manchester-based, Darwin Group. Since its launch in 2011, Evolution Money has grown to be regarded as one of the fastest growing finance companies in the UK, being recognised in “The Sunday Times Virgin Fast Track 100”. Evolution Money has built up a substantial loan portfolio in just over eight years, having lent more than £210m to more than 23,000 customers across the UK.

The MEN Business of The Year Awards will take place on Thursday 14th November at Principal Hotel Manchester

For more information about Evolution Money, visit: www.evolutionmoney.co.uk

Evolution Money are delighted to announce a new 3 year, £100m Senior debt facility with NatWest which secures the capital requirements for the business over the coming years.

This facility will allow Evolution to continue delivering its growth plans whilst capitalising upon exciting new product opportunities.

Commenting on the facility, CEO Steve Brilus said: “I am delighted that we are continuing our partnership with NatWest who have supported Evolution since 2013. This sizeable commitment reflects our strong working relationship with the NatWest team, their confidence in our business and a shared vision of the future opportunities that exist in our sector“

Matt Glew, Relationship Director of NatWest’s Large Corporate & Institutions business, added “We are very happy to have closed this new facility with Evolution, and are looking forward to continuing to work closely with Steve and the team as the business moves into the next stage in it’s journey. We have extensive experience in the 2nd charge mortgage sector and are excited to see Evolution grow with our support.”

Filip Skolnik, Structured Finance Director at NatWest, added “This commitment is a testament to the quality of the business that Steve and the Evolution team have built over the years, and we are pleased to have supported the business during it’s earlier years and having now structured a new financing solution that will enable progression to the next exciting growth stage.”

Evolution Money are proud to announce they have won the Feefo Gold Service award for 2018.

This independent award recognises businesses who deliver exceptional experiences rated and reviews from real customers.

Created by Feefo, Trusted service is awarded only to those companies that meet the high standard, based on the number genuine reviews collected and average rating received. This accreditation remains unique, as it is based purely on the interactions with verified customers. All reviews are verified as genuine, the accreditation is a true reflection of a business’ commitment to outstanding service.

Lynne Hardwick Head of Marketing said “It’s a real honour to be recognised for delivering exceptional service for our customers. We’ve been working hard to ensure our customers receive the best possible service. We’re looking forward to another successful year ahead”.

Speaking on this year’s award, Andrew Mabbutt, CEO at Feefo, commented: ‘The Trusted Service award has always been about recognising those companies that go the extra mile. Once again, we have seen many incredible businesses using Feefo to its full potential, to provide truly memorable experiences for their customers – and rightly being awarded with our most prestigious accreditation. I look forward to the continual success of the businesses that work in partnership with Feefo throughout 2018.’

To achieve this coveted Gold Trusted Service 2018 award, Evolution Money collected at least 50 reviews and achieved a Feefo service rating of 4.5 and 5.0. from January to December 2017.

Evolution Money are honoured to be receive this accredited award and are committed to continuing in working hard to deliver outstanding levels of customer service in the future.

Evolution Money, a secured loans provider based in Manchester, has been featured on the Sunday Times Virgin Fast Track 100 league table for the second year in a row.

Published every December, the research highlights those British companies who have achieved the fastest-growing sales within the last three years. Featured for a second time, Evolution Money successfully claimed the 82nd spot as their annual sales increased by more than 52% throughout this period.

Lynne Hardwick – Head of Marketing at Evolution Money – was delighted by the news:

“This is a fantastic achievement and we are extremely proud of all our staff and their continuing efforts. We clearly couldn’t do it without their hard work and support.

“When you consider how many thousands of private businesses there are, appearing anywhere in the top 100 is very special. We are delighted to appear once again in the Sunday Times Virgin FastTrack100.”

The league table is compiled by Fast Track and published in the Sunday Times every year. To qualify, firms must meet a variety of conditions. For example, they must be registered in the UK and have variable sales growth throughout the three-year-period. Of those included in the list, two others were from Manchester – Missguided and CarFinance 247.

Based on Portland Street, Evolution Money is part of Darwin Loan Solutions, and alongside its sister company Progressive Money, employs more than 140 staff members. The firm hopes to continue growing and make it third time in a row during 2018. In the meantime, Evolution Money is planning to celebrate this achievement at their Christmas party.

The 16th of May is a very special day on the Evolution Money Calendar – it’s our birthday!

So, this time 6 years ago what was happening…? Well, our colleague James was sitting at his desk (as he is today) but back then he was very excited at the thought of us funding our very first loan, a loan for £750.

It was Monday 16th May 2011 and the business was packaging its very first loan. We had been preparing for this moment for five months and the tension was building… we packaged it, approved it and prepared it for a pre-funding review.

The file was passed to our FD who scrutinised it to within an inch of its life, before he counter-signed it and we were ready to go…

At 16:44 on Monday 16th May 2011 we hit the button and the funds were transferred and that was it, our first loan was funded and Evolution’s journey had begun…!

Fast forward 6 years and what does the business look like today?

Well, we are now a multi award winning, multi-million-pound business…

We’ve outgrown the stationery cupboard we started out in and now employ over 150 people. From that first loan for £750 we have gone on to lend a staggering £134m to over 14,000 customers. That’s certainly something worth celebrating.

One of the highlights of the last six years must be watching how people have grown with the business and seeing new people join. At Evolution Money, we truly do have a brilliant team of people. It’s testament to the business that many of the original team are still here all this time later.

Six years on, as MD, I am still as excited as I was when we funded that first loan. The building blocks have been secured for the future and the business continues to grow from strength to strength.

The future is still for us all to determine and if we work together it will be great. We must remember the founding value of our business, succinctly rolled up in one word – TRUST.

Trust that we are doing the right things every day. Trust from our investors that we are running a compliant and robust business. Trust from our customers that we interact with them in a fair and transparent way, ensuring they are at the heart of everything we do. Trust from our colleagues that we are all working together and that no one individual is more important than the team…. If we achieve this then we will continue to have a great business.

On behalf of myself and the rest of the Directors a huge THANK YOU to both our customers and our team for the journey so far and we look forward to working with you for the next 6 years…

Mat Beaver,

Managing Director

The Darwin group – which offers secured and unsecured loans to customers through Evolution and Progressive Money – is delighted to announce a new funding facility of in excess of £75m which supports the Groups objective of becoming a leading consumer finance brand in the UK.

The award-winning Evolution, ranked as one of the fastest growing finance companies in the UK as recognised in “The Sunday Times Virgin Fast Track 100”, and its sister company Progressive Money, have built up a substantial loan portfolio, having lent more than £120m in just over 5 years.

Joining the original funding partners, NatWest and Shawbrook Bank, are Insight Asset Management and another UK-based private credit manager, all four of whom have significant experience in financing consumer finance lenders and a shared desire to see Evolution and Progressive Money increase market share through both organic growth and the development of new and innovative products.

Steve Brilus, Chief Executive of Darwin said “We are entering an exciting new phase of growth and I am delighted to have such forward-looking and supportive funding partners investing in our business. This funding provides the springboard to enable us to achieve our ambitious plans and to take Evolution and Progressive Money to the next level”.

Evolution and Progressive Money were advised by the Financial Services Corporate Finance team at EY.

Mat Beaver, Managing Director of Darwin said “We are grateful to Nick Parkhouse and the team at EY for facilitating this transaction. They have worked closely with us in understanding our business and our plans, and have supported us throughout the process.”

Manchester based lender Evolution Money is proud to announce its expansion into new city centre premises. Securing the deal for the coveted location earlier on this year, the move was inevitable for the loan provider, having out-grown its previous home near the busy Spinningfields area of the city. Evolution Money has now relocated to the newly refurbished and larger 12,000sq ft offices at 9 Portland Street, Manchester.

Manchester based lender Evolution Money is proud to announce its expansion into new city centre premises. Securing the deal for the coveted location earlier on this year, the move was inevitable for the loan provider, having out-grown its previous home near the busy Spinningfields area of the city. Evolution Money has now relocated to the newly refurbished and larger 12,000sq ft offices at 9 Portland Street, Manchester.

The Grade II-listed property in the Piccadilly commercial area underwent renovation at the end of 2014, with Evolution Money now taking the entire third floor of the building which has been fully fitted out and designed for the company.

Kerri Turtill, Operations Director at Evolution Money commented: “We are excited about the next phase of development of our growth and we feel the high quality accommodation we have secured at 9 Portland Street will give us the platform to achieve our objectives.”

Evolution Money has grown steadily and robustly since being established in 2011, and has developed to be a key player in the second charge sector, recently celebrating its fourth birthday. The business now boasts a strong workforce of over one hundred employees and is set to grow further through its ongoing recruitment strategy and significant investment for training and staff development.

2015 will see the multi-award winning lender grow and build on the previous years’ successes with the promotion of the Evolution loan products and lending range through its business partners and directly to customers.

Evolution Money are once again celebrating today after impressively scooping their second award so far this year, and winning the coveted Financial Reporter Awards, Best Secured Loan Lender 2015.

Evolution Money are once again celebrating today after impressively scooping their second award so far this year, and winning the coveted Financial Reporter Awards, Best Secured Loan Lender 2015.

Rhian Roberts, Head of Evolution Money Broker Division commented:

‘What a fantastic result for Evolution Money to be awarded Best Secured Loan Lender of the Year in this year’s Financial Reporter awards. This award once again proves that our robust stress testing, responsible lending and dynamic product mix is very highly thought of throughout the industry. A huge thank-you to all our brokers and introducers who have voted for us, it truly is an a amazing result’

The significant accolade which garners votes from industry peers and professionals alike not only recognises top-notch excellence across the lending arena but how important and well-respected Evolution Money has become within the industry over the past four years. Offering a wide-ranging suite of secured loan products which match customers’ needs and requirements, Evolution Money has grown significantly to be a key player in the second charge sector.

Earlier on in the year the specialist lender won Best Adverse Secured Loan Product of the Year 2014 at this year’s Loan Talk Secured Loan Awards. Today’s award follows on from last year’s 2014 Financial Reporter Awards where Evolution Money received a Highly Commended rosette as Best Specialist Lender.

Operations Director Kerriann Turtill said about winning the award:

“Once again Evolution Money continue to stand-out as a market leader. These awards are key industry benchmarks which recognise our innovative approach, and we are very excited and proud to have won Best Secured Loan Lender 2015. Relationships with our partners are important to us – We know our products meet the needs of ours and our broker partners’ customers, and the award is key to acknowledging that as it was voted for by our industry peers and professionals which we work with on a daily basis’’

The winners’ presentation ceremony will take place on 19th May 2015, at Manchester Museum of Science & Industry. Attended by this year’s victors, runner-ups and industry professionals, the event should prove to be an evening to remember.

For a full list of all the winners please go tohttp://www.financialreporter.co.uk/awards/winners-2015/

Representative 22.93% APRC variable.

For a typical loan of £26,600 over 180 months with a variable interest rate of 19.56% per annum, your monthly repayments would be £484.00. This includes a Product Fee of £2,660.00 (10% of the loan amount) and a Lending Fee* of £763.00, bringing the total repayable amount to £87,030.00. Annual Interest Rates range between 11.7% to 46.5% (variable). Maximum 50.00% APRC. *Lending Fee varies by country: England & Wales £763, Scotland £1,051, Northern Ireland: £1,736.

Think carefully before securing debts against your home may be repossessed if you do not keep up repayments on your mortgage or any other loan secured against it. If you are thinking of consolidating existing borrowing, you should be aware that you may be extending the terms of the debt and increasing the total amount you repay.