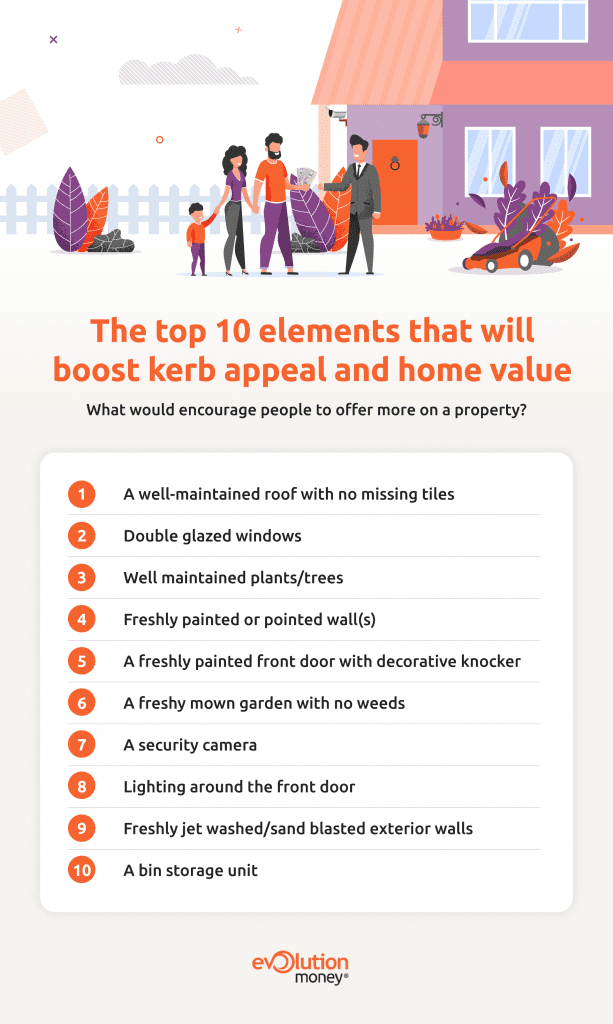

We’ve investigated what exterior features can make your home more attractive to prospective buyers, and even increase its value.

We all know that even if we’re not looking to buy a property, we still form an opinion of it from the moment we see it. But how much does that first impression impact our overall decision to buy a property, and how much we’re prepared to pay for it?

To find out, we asked 2,000 UK residents just how much ‘kerb appeal’ impacts their decision when they’re house hunting.

Our research reveals that most people (93%) pass judgement on a property based on purely on how it looks from the outside, and the exterior appearance of a home has the power to affect its value too, with three in ten (30%) happy to pay an extra £5,000 or more for a home with a well-maintained exterior. But which elements are particularly persuasive when it comes to generating that extra cash?

Double glazed windows (37%), a well-maintained roof with no missing tiles (37%) and well-maintained plants or trees (25%) were the top three contenders when it came to encouraging a higher offer for property.

While these can be expensive to install or fix there are several cheaper ways to make a property more appealing to perspective buyers:

-

- A freshly painted door is inexpensive and encourages one in five (19%) people to offer more money

- A neat lawn (19%)

- Freshly jet washed walls (13%) or path (12%)

- A clean car in the driveway (10%) are also key to consider when trying to achieve maximum ‘kerb appeal’ and property value.

Interestingly, it is the younger generation (18-24s year-olds) that are most comfortable offering more money for a home with a well-maintained exterior, and it is also this generation that value non-permanent or low-cost features too such as a clean car on the driveway (14%), a house name (11%) and a bespoke house number next to the front door (11%).

The outside appearance of a property also has the power to put potential buyers off buying it altogether and even lower its value too. Crack(s) in the exterior walls (64%), damaged windows (61%) and a roof with missing or uneven tiling (57%) were all identified as key elements that take away from a property’s ‘kerb appeal’.

In addition to these, an unmown lawn (26%), visible rubbish bins (21%), a very brightly coloured front door (19%), a lack of outside lighting (9%) and washing hanging outside (7%) also have an adverse effect on the first impression of a property.

Again, it would appear as though the younger generations are more guilty of judging a property by how it looks from the outside, with 98% of 18–24-year-olds admitting to deciding if they like a house before they’ve even stepped inside it.

We spoke to Craig Bray, Divisional Director at Yopa estate agents about our research findings and he said: “Would-be sellers can really boost the value of their property with some simple, tactful renovations.

“At Yopa we estimate that simply improving your property’s ‘kerb appeal’ with a freshly painted exterior, clean windows, clear gutters, a tidy driveway and a freshly painted front door can boost the value of a property by up to 10%.

“First impressions count, and the outside of your property is the first thing potential buyers will see, both when browsing online and in person at a viewing.”

The ONS quoted the average UK house price as being £251,000 in April 2021, which means that according to Craig at Yopa, a well-presented property could achieve an additional £25,100 in value.

If you’re a homeowner who is looking to improve the ‘kerb appeal’ of your property, then our Homeowner Loan could provide you the cash you need to make those all-important changes.

Don’t forget, we’re here to help! We have listed some frequently raised questions and answers which may help you when you’re considering a loan provided through Evolution Money.

Alternatively, you could contact us directly or use our no-obligation application form to get an idea from an adviser of what loan could be available to you.

Evolution Money surveyed 2,000 UK adults in August 2021.

Whether you’re looking for a cool cruiser, a sleek sports bike, or a zippy runaround, there are plenty of motorcycles to choose from. Not all, however, will be suitable for the beginner biker.

To help new riders find the right bike for them, this article explores a diverse selection of motorbikes to suit any budget.

1. Aprilia RS4 50

Designed specifically for young riders, the Aprilia RS4 50 is perfect for beginner bikers. Celebrated as ‘the superbike for 16 year olds’, the RS4 50 features a 50cc two-stroke engine, six-speed gearbox and a race-style rev counter with digital speedo, to offer the authentic experience of a sportbike.

Featuring Aprilia’s innovative technology, this racer replica can be a little expensive for a first bike – but it’s completely worth it. Be prepared to spend around £3,000 to get a second-hand one in good condition.

2. Honda Vision 50

If you’re looking for something to nip around town in, try the less powerful, yet equally as fun, Honda Vision 50. While it is technically classed as a scooter, the Honda Vision 50 is easy to ride, economical and reliable, making it perfect for city riding and commuting. You’ll also benefit from a spacious, comfortable seat which could easily fit two people, and thanks to its sleek shape and lightweight nature, the Honda Vision 50 easily conquers congested streets.

For a good-quality second-hand model, you’ll probably want to spend around £1,200, although you can get ones for as little as £450 if you’re on a strict budget.

3. AJS JSM 50

The AJS JSM 50 is a sporty scrambler-style bike, perfect for new riders seeking something thrilling, but not too powerful. Featuring an impressive six-speed gearbox and a 49cc two-stroke engine, this zippy, all-terrain looking bike is great for AM licence holders. Aesthetically, the JSM 50 is exciting, with its strong satin black alloy wheels and its vibrant, bold bodywork.

Stylish and affordable, you can buy one of these mean machines for around £1,700, depending on the condition.

4. Yamaha MT-125

Designed with young riders in mind, the Yamaha MT-125 is budget-friendly, reliable and extremely good looking. With a three-section digital dash which displays a clock, petrol gauge, trip time, mpg, distance to service and average speed, the MT-125 features everything a new rider could hope for.

Despite featuring a speedy yet not-too-powerful 125cc engine, the MT-125 boasts a ‘big bike’ feel and riding position with its naked chassis, athletic styling and wide-fitting handlebars. Depending on the condition of the bike, you can get a second-hand MT-125 for £2000 to £4000.

5. Kawasaki KLX250S

For someone seeking a little more power after passing their mod 2 test, the Kawasaki KLX250S features a 250cc, four-stroke engine and can be ridden legally both on and off-road. With a large, cushy seat and a natural riding position, this dual-sport bike is surprisingly quiet, comfortable and easy to ride.

While it’s not the most powerful off-road bike out there, the Kawasaki KLX250S can easily keep up with motorway traffic, as well as tear through mud with ease, climbs moderate hills and pull itself through deep sand – perfect for up-and-coming adventure bikers.

To get your hands on a second-hand model in good condition, look at spending anything from £3,250. If you want a real bang for your buck, the Kawasaki KLX250S is a great choice.

6. Harley-Davidson Street 500

The Harley-Davidson Street 500 is the perfect cruiser for bikers who are looking for something a little more laid-back, but still powerful. Since its release in 2014, the Street 500 and Street 750 have surpassed the Sportster and became the motor company’s go-to starter bike. Featuring a 492cc, liquid-cooled, ‘Revolution X’ v-twin-engine, the Street 500 was specifically designed to dominate the city streets and appeal to new riders.

While it is rather large and heavy for a 500cc, the cruiser offers a low-set seat which makes it easier for new riders who need to be able to reach the ground quickly. Reach to the bars is natural, with a relaxed seat position, making it an ideal cruiser for new riders with a smaller build, who are seeking a bike for city riding. For a second-hand Street 500, be prepared to spend around £5,000.

7. Honda CMX500 Rebel

Stylish, lightweight and fun, the Honda CMX500 Rebel is a novice-friendly cruiser featuring a reasonably powerful 471cc liquid-cooled, four-stroke engine. The Rebel is perfect for riders with a small build, thanks to its low seat and lightweight frame. Above all, it’s reliable, versatile and makes for a fun ride, especially suitable for cruising around town with ease.

The Honda Rebel is also available in 300cc – great for new riders who aren’t yet used to the power of a 500cc. As a side note, you’ll need an A2 licence to ride this beauty. Another budget-friendly cruiser, the CMX500 Rebel can cost around £4,000 or more depending on the condition of the bike.

8. Suzuki Bandit 600

The Suzuki Bandit is an ideal starter bike for those looking for a more powerful ride with the promise of reliability. First released in 1995, the Bandit was one of the first budget middleweight bikes, coming after Yamaha’s Diversion which was launched in 1991. In fact, the Bandit was considered the better of the two bikes because it was significantly cheaper, good looking, and served its purpose perfectly as a speedy yet budget-friendly bike.

With a top speed of 125mph, the Bandit is not only fast, but it handles well – which is great for new riders learning to handle a more powerful bike. Nowadays, Suzuki Bandits range from £600 to £2000 depending on the condition – an excellent price for such a powerful bike.

9. Suzuki SV650

Featuring a 645cc V-twin engine, the Suzuki SV650 is powerful but not quite enough to intimidate a new rider. In fact, the bike offers an impressively smooth ride and is moderately lightweight, making it easy to handle.

Featuring a Low RPM Assist helps avoid stalling, which is great when you’re a new rider. Practical and comfortable, the Suzuki SV650 features an upright riding position while still maintaining a very sporty feel. As a bonus, the Suzuki is fuel-efficient with an average of 48mpg.

You can get your hands on one of these beauties for around £3000 – £6000, depending on the condition.

10. Triumph T120 Bonneville

At a glance, you may not think that the Triumph T120 Bonneville would be a suitable bike for beginners, but take a little time to get to know the ride, and you’d be wrong. Fitted with a powerful 1,200cc twin-parallel high torque engine, the T120 Bonneville has plenty of power to get you where you need to go without fuss. As a cruiser, the T120 is powerful enough to be fun without the fear factor.

With a mid-range, surprisingly comfortable seat, you get a good balance between control and a relaxed riding position. As with many of Triumph’s classic creations, the T120 Bonneville boasts a timeless beauty with its handcrafted chrome detailing, heated grips, and 160 available accessories.

Costing anywhere between £8,000 – £11,000 depending on the condition, the T120 Bonneville may be slightly more expensive than the other beginner bikes listed here, but it definitely makes up for it in performance.

Secured Motorcycle Loans at Evolution Money

Whether the Vision or the Bandit has caught your eye, or you’re hoping to keep your options open by buying and insuring more than one bike, finding your first motorcycle can be difficult. For beginner bikers, the more research you conduct and the more experience you gain from handling and trialling different bikes, the more informed your decision.

Also, for those concerned with affordability, at Evolution Money, we’re able to offer motorbike loans to help you buy your ideal bike. Our motorbike loans range from £5,000 up to £50,000.

We take your personal circumstances into account and offer affordable repayment rates to suit you. For more information on secure motorcycle loans at Evolution Money, contact our qualified loan advisors at Evolution Money today for a no-obligation quote on 0161 814 9158.

Typical usual statements will be contained within the footer that is displayed on every page on the website

What’s Been Happening?

In the closing months of 2018, a number of high-street banks across the United Kingdom were hit with significant IT failures that impacted customers’ ability to access online services.

In the UK, for the last few years at least, we’ve been constantly bombarded by the press about the growing online threats of hacking and data theft. However, as banks rush to make the necessary improvements to their IT infrastructure, it’s being increasingly noticed that customers are finding access to their own cash can often become impaired during the process; in some cases, people have even missed important payment deadlines despite them having the required money in their accounts.

According to Which, banks in the UK are affected by serious IT failures and outages on a daily basis. From the 1st of April 2018, through to the end of the year, Which discovered that exactly 302 reports were filed by 30 of the UK’s major banks and building societies regarding serious IT failures – this averages out at roughly one incident a day!

Barclays reported the largest number of major incidents, at 41 over the investigated period. This was closely followed by Lloyds Bank with 37, Halifax/The Bank of Scotland with 31, NatWest with 26, RBS with 21 and the Ulster Bank with 18.

Furthermore, ClearScore recently conducted an eye-opening survey, specifically targeting individuals affected by these banking service outages. The results of this survey highlight the significant impact service outages have had upon banking customers; of the 2,000 people interviewed for the survey after experiencing a service outage, roughly 67% found errors in their credit history.

However, it appears that many more mistakes might be sailing under the radar; data suggests that roughly only around a quarter of banking customers actually think to check their Credit Scores after service outages. Additionally, a third of customers have never even considered checking their Credit Score – regardless of whether or not they’ve experienced a service outage.

How Does It Affect Me?

If online services are impacted by outages, people can be left unable to make important payments – leading them to miss payment dates. Missing payment dates can have a significant impact upon a customer’s credit score, and this is especially unfair to customers who’ve had the money in their accounts but were unable to access it.

In some cases, defaulting on an important payment may incur costly late payment fees. Such fees can have staggering effects on customers with irregular streams of income; you could potentially be pushed over your credit limit or into your overdraft, both of which have a chance of damaging your credit score further. Worryingly, having a poor credit score can often affect your ability to qualify for a new mobile phone contract, a loan or even a mortgage.

If you’re worried that your credit score might have been adversely affected as a result of a banking service outage, feel free to check your credit score out now using an online service.

What Should I Do If I’ve Been Affected?

If you’ve spotted an error in your credit score that was most likely caused by something outside of your own control, here’s what you can do to fix it:

Talk to the Bank, Company or the Lender

Ideally, your first stop when trying to fix a credit inaccuracy error should be to contact the company or lender who you’ve been unable to pay because of the service outage. Many companies and lenders will likely be happy to amend the error immediately; however, you should be prepared to go through your company’s, or lender’s, official complaints procedure.

Talk to the Relevant Credit Reference Agencies

As your credit score is a reflection of your financial behaviour, and also belongs to you, it’s important to ensure it’s accurate. You therefore have the right to dispute any information it contains if you think it is incorrect.

If the company, or lender, is unwilling to address the problem, you may have to go directly to one of the UK’s three Credit Reference Agencies: Experian, Equifax or TransUnion. Experian, Equifax and TransUnion all have online forms you can complete that will allow you to raise a query concerning late payments due to bank IT outages. In order to settle the dispute, the Credit Reference Agencies will investigate the issue and contact all related parties.

If the company or lender you are having trouble with fails to agree with your assessment of the events, there’s no need to feel hopeless – a Notice of Correction can also be applied to your credit score file. A Notice of Correction is typically a 200-word explanation of the events from your perspective, usually describing how this incident isn’t reflective of your usual financial behaviour.

How Do I Improve My Credit Score?

A person’s credit score should represent an accurate record of their financial history. There’s no need to worry though if you have a low credit score from prior circumstances – there’s plenty you can do right now to begin to improve it.

Whether it’s by ensuring you’re registered with the electoral roll at your current address, or by applying for a credit-building credit card, there are multiple ways you can begin to rebuild your credit score. For some top tips on how to repair your credit score, check out our fantastic blog post on improving your credit score.

1# https://www.which.co.uk/news/2019/03/revealed-uk-banks-hit-by-major-it-glitches-every-day/

2# https://www.which.co.uk/news/2019/04/two-thirds-of-people-find-credit-score-errors-after-bank-it-failures/

Evolution Money, a secured loans provider based in Manchester, have been nominated as a finalist in the MEN Business of The Year Awards.

The announcement follows the recent news of a three-year, £100m senior debt facility with NatWest, continuing a strong year for the company.

Steve Brilus, CEO of Evolution Money, said: “We’re honoured to be nominated in the prestigious MEN Business of The Year Awards. As a Manchester founded company, it is a privilege to be a finalist alongside so many other fantastic local businesses.

Evolution Money has had an incredibly successful 2018 and 2019, but none of our achievements would have been possible without the valued contribution of each member of the Evolution family.”

Steve added: “At Evolution Money, we are always striving to evolve and innovate in order to support our future growth and on-going commercial success. Our focus will always be our customers, ensuring responsible lending is at the heart of everything we do.”

Award-winning Evolution Money, is part of the Manchester-based, Darwin Group. Since its launch in 2011, Evolution Money has grown to be regarded as one of the fastest growing finance companies in the UK, being recognised in “The Sunday Times Virgin Fast Track 100”. Evolution Money has built up a substantial loan portfolio in just over eight years, having lent more than £210m to more than 23,000 customers across the UK.

The MEN Business of The Year Awards will take place on Thursday 14th November at Principal Hotel Manchester

For more information about Evolution Money, visit: www.evolutionmoney.co.uk

The Premier League 2019/20 season is now in full play and recently transferred players, up and down the UK, have started to settle in to their new teams.

A recent study by Evolution Money has revealed which UK towns and cities have produced the most valuable talent of all the UK-born players, playing in the 2019/20 Premier League season.

The capital boasts the lion’s share of valuable players, with the market value of London-born players reaching an impressive, £503.64m. There are 39 players in this seasons Premier League hailing from London, making London the UK’s largest producer of football talent.

Despite having such a large pool of players contributing to London’s market value, one star player contributes a huge 25 percent of the total market value for the city. Walthamstow born, Tottenham Hotspur forward, Harry Kane, currently boasts a market value of £135m, making him the highest valued player in the league.

Following London, in places two to five, are four cities located in the North of the UK; Liverpool (£141.16m), Sheffield (£128.25m), Manchester (£127.12m) and Glasgow (£81.45m).

Both Liverpool and Manchester have produced players with a current market value of a striking £72m. Marcus Rashford, from Manchester and Trent Alexander-Arnold, from Liverpool, are each responsible for over 50 percent of their cities market value. Both also play for teams in the cities they were born, Manchester United and Liverpool FC.

Robin Russel-Fisher, Finance Director at Evolution Money, said: ‘’It’s really interesting to see which UK towns and cities have produced the hottest players in this season’s Premier League and it’s great to see that the talent comes from all across the country.

As a Manchester founded company, we were particularly pleased to see that Manchester made it into the top five.”

At Evolution Money, we understand that people can need a helping hand with their finances from time to time, that’s why we offer convenient and flexible financial solutions to our customers throughout the UK.

Some of the towns and cities with a place in the top 15 have earned their spot with the value of just one player. Milton Keynes, in position seven, has produced only one player currently playing in the Premier League, Dele Alli, however Alli has a current market value of an incredible, £81m. The northern town of Barnsley also has only one homegrown star in the Premier League this season, John Stones, with a market value of £54m, putting his town in position 11.

In the internet age, we have access to more information than ever before. However – while this technology has proved greatly beneficial – it has also led to a variety of problems. For example, ‘fake news’ is not just limited to media coverage but also spread to how we process information.

This includes how we manage our finances. Navigating this world can be challenging to begin with but there is so much misinformation about credit scores out there that we keep hearing the same myths again and again.

Hopefully, we can now put some of these falsehoods to rest while clarifying those which will have any sort of impact on your credit score.

Your credit score explained

First, let’s explain what your credit score actually is. While we’ve covered this in detail within our help and advice section, your credit score basically indicates how much of a potential risk you could be to lenders.

The higher your credit score generally is, the more responsible you will appear to these organisations. Negative elements such as missed bill payments, multiple credit cards, or county court judgements can reduce this figure and might prevent you from obtaining certain financial products.

We also have a range of hints and tips if you want to repair a poor credit score.

Top myths about credit scores

Although there’s a substantial amount of information out there related to credit scores, we continue to hear inaccuracies about what influences these figures. We’ve detailed those we hear most often below:

Every person has one credit score

False. Nobody has a single credit score or rating that is used to assess their eligibility for credit; instead, credit checks are completed at the discretion of each credit provider. This means that people can have multiple scores at any one time, depending on the individual criteria of each agency.

These credit scores vary as different agencies operate on unique scoring models. Regardless, the higher these figures are, the better financial products you should have access to.

Previous occupants of your house can affect a credit score

False. It’s a common misconception that the previous occupant of your property can impact your credit score, or that the credit history of a particular house somehow passes over to the next person who moves in.

These days, credit checks are conducted on individuals, rather than addresses. In most cases, your personal credit score does not factor in the financial situation of others, unless you have received approval for a joint credit application or are financially associated with another person.

Never borrowed money? You will have a good credit score

False. Although it’s logical to think that if you’ve never had the need to apply for credit then you must have a tight handle on your finances, this doesn’t necessarily mean you will have a good credit score.

When assessing any application for credit, most lenders are keen to see evidence that a person has borrowed money in the past and has been able to pay it back on time. Many people look to solve this issue by taking out a credit card, not because they need the extra funds, but because they can use it to build a history of well-managed credit repayments.

Bad credit lasts forever

False. Many people are worried about the future impact of their credit decisions, particularly if they have missed repayments in the past.

The good news is that credit checks are designed to be an accurate and detailed picture of a person’s current financial situation, and so the majority of lenders will only take into account credit information within the past six years.

Checking your credit report harms your credit score

False. Checking your credit report will not adversely affect your credit score. Although there are paid and free ways to do this, you can request this check as many times as you like to observe fluctuations in your score.

When lenders are assessing how much of a potential risk you are, they will take into consideration the applications for financial products left on your report. Events such as a soft credit enquiry (when credit is not investigated as part of a lending decision) or checking your credit score will not factor into this analysis.

Therefore, as long as you are not routinely applying for products in order to determine your score, you won’t be adversely affected by making regular checks.

Employers can check your credit score

False. One of the most prevalent myths about credit scores states these figures can be reviewed by an employer. This is not true and the problem likely arises from individuals using the phrases ‘credit report’ and ‘credit score’ interchangeably.

Although an employer can review your credit report, this differs from the one typically seen by lenders and is often used to indicate how financially responsible a worker is – especially so if the job requires handling large amounts of funds.

Furthermore, he or she cannot do this on a whim. If an employer seeks to review your credit report (not all employers would want to) you must give written consent.

You can be on a credit blacklist

False. There is no such thing as a credit backlist. We can assume that if such a document did exist (and you were on it) you would be banned from borrowing funds and find it extremely difficult to be removed.

If someone is turned down repeatedly for financial products, he or she might assume they are on a blacklist – which is probably how the rumour started. However, there are lots of factors which can influence how likely an application is to succeed.

If that individual worked on improving their credit score, they would soon realise that they haven’t been blacklisted by lenders at all.

When applying for a loan, mortgage, or credit card, your credit score will typically be evaluated to determine how safe a borrower you are. During the check itself, a variety of potential factors will be reviewed. These could include:

- Your name and date of birth.

- The value and length of any loans, credit cards, or mortgages taken out in that person’s name.

- The conduct of these loans. For example, highlighting if any payments were missed.

- Your history of utility bill payments, phone bill payments, and other bills.

- Your history of previous loan applications.

- Your payment profile – if there have been any late payments or if payments have been made on time.

Depending on what credit score you have, this will have a bearing on what sort of financial products you can obtain. Those with an extremely low credit score may struggle to gain access to any sort of loan – or might be required to pay higher rates.

What is a bad credit score?

When lenders are evaluating credit scores, they will do so against a scale. Although variations exist across agencies, Experian’s scale ranges between 0 and 999. Under those measurements, a score of 881 or more is classified as ‘good’. A credit score under 720 though is described as ‘poor’.

When determining these scores, certain aspects of a person’s history will have greater weighting than others. For example, according to Experian, the most important factor is an applicant’s payment history – making up around 35% of the total score.

Regardless, if your credit score falls within the ‘poor’ range, this is no cause for despair. The good news is these ratings can be improved with some hard work.

How to fix a bad credit score

The first step to fixing a poor credit score is determining where the problem lies. As mentioned earlier, this rating takes a variety of factors into account so learning which one negatively affects your score is a great step in the right direction. Therefore, before doing anything, you should request to view your credit report.

Once obtained, you should review it in detail to determine that the information is accurate.

The importance of fixing inaccuracies

Although inaccuracies might include basic errors, such as incorrect address details, reviewing this report can also identify fraudulent activities.

If someone has made an application for a loan in your name, then this could have a detrimental effect on your credit score. Although this should be reported immediately, other mistakes ought to be highlighted to the organisation which supplied the original information.

You may also choose to add a ‘notice of correction’ as a way to highlight extenuating circumstances. For example, hospitalisation preventing you from working and, therefore, causing you to miss a mortgage payment.

How else can I improve my credit score?

Once you’ve determined how accurate your credit report is, you can begin to take steps to improve it. Fortunately, they are a variety of ways you could do this:

- Paying bills on time. It sounds obvious, but this is a great way to demonstrate your trustworthiness to potential lenders.

- Resolve your debts. It is advisable to clear your debts before taking on additional finances as well as closing any unused credit cards. Clearing this may make you more attractive applicant to some lenders.

- See who you share accounts with. You might have a spotless credit history, but does your spouse? If your credit report is linked with a person who has a poor credit score, you might find it harder to obtain a good deal. In this situation, that individual could benefit by taking some of the steps mentioned here.

- Reduce the number of credit cards. Having too many cards may be seen as an inability to effectively manage your finances without resorting to multiple credit options.

- Get on the electoral register. This is important as the electoral register is one of the best ways for lenders to check/confirm your information.

- Build your credit history. Even if you have no debts, you might have a poor credit score as there is no record of responsible payment. In this situation, applying for a credit card or credit-builder loan could help rectify this.

- Seek advice from the Money Advice Service, an independent service set up to help people manage their money.

How long will it take to improve my credit score?

Sadly, there is no quick way to do this. Potentially, it might take months or even years before you improve your credit score. However, in many ways, this can be viewed as an opportunity.

Improving a credit score is a marathon, not a sprint. Much like how the best runners don’t immediately start with a challenging event, taking small steps now will likely yield more positive results in the future.

Therefore, start slow. Understand the points in your credit report and strive to improve these one at a time. Alternatively, if your debts are getting on top of you, consider professional advice or consolidating your loans into affordable monthly repayments.

Whether you plan on selling your house in the near future – and want to set a higher asking price – or you simply need a bit of a change in your day-to-day living, there are plenty of options to consider when it comes to home improvement.

Of course, every person or family has their own distinct priorities. You may need to replace a faulty oven, create more space within the house, redecorate a particular room, or even transform the garden into a liveable space. While any increase in total market value depends on how much you choose to invest in the first place, everybody can do a few things to get the ball rolling. In this guide, we will look at some of the factors which can influence property value as well as suggest a few small tweaks which can go a long way.

How can location affect the value of my home?

First, let’s focus on something you can’t change – where your home is based. The effect of location on property values can vary depending on a number of external factors. For example, living in an area with an excellent local economy which features a good community spirit can do wonders for property prices. In a similar fashion, if a school is due to be built near you, the value of your home could increase.

One report, published in the Independent, highlighted the effects of having a supermarket on your doorstep. According to the report, living near a Waitrose could add more than £36,000 to the value of a home. In fact, being in close proximity to any major supermarket may improve property prices by approximately £22,000.

This has lead to some individuals describing this as the ‘Waitrose effect’.

In 2017, an article in the Guardian highlighted the areas of the UK where property prices were increasing. Over a 12-month period, the North West saw the greatest hikes with a seven percent gain in house values. In contrast, the value of homes in London had a regional increase of 2.5%.

Therefore, although you can’t change where your property is based, there are external factors which can affect its value. As well as spotting the addition of amenities such as a supermarket, This is Money has highlighted other factors.

For example, according to the organisation, the arrival of niche food chains – such as delicatessens – can be a sign that the local population is becoming more affluent and will have more disposable income.

Furthermore, an increasing youth population can be positive. Afterall, the publication argues, the majority of these will be young professionals who require access to transport links and local businesses. As a result, this demand will bring these organisations to the area and improve the area – increasing house prices as a result.

However, be aware that you won’t be the only one looking for these indicators. Anecdotally, there are stories of house visits turning into queues of potential buyers. As a result, these desirable properties can go for much higher than the original asking price.

Therefore, it requires plenty of foresight – and a bit of luck – to benefit from these changes.

How can I improve the value of my home?

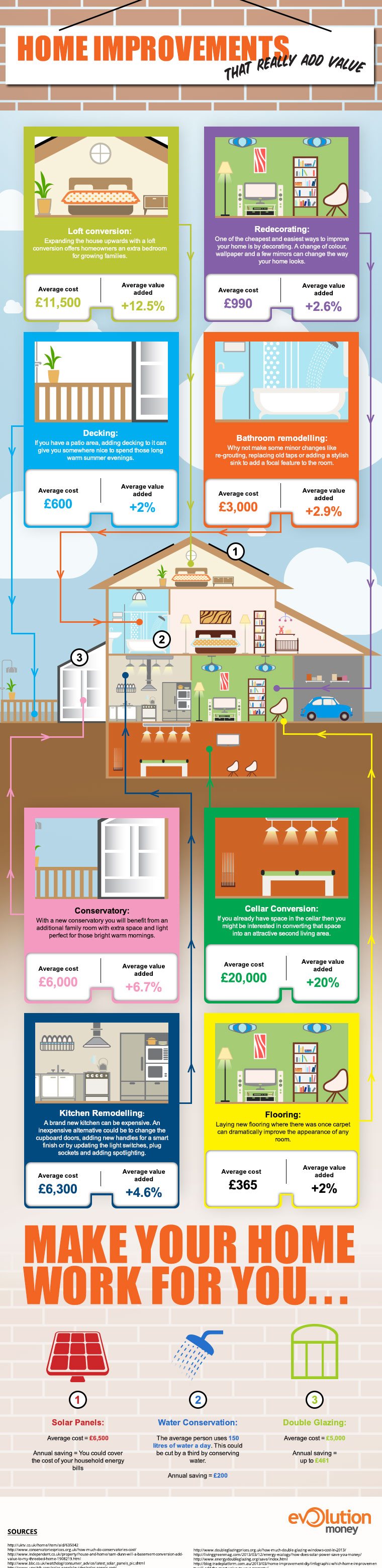

Although location is an area you won’t have much influence over, there are lots of elements you can control. We’ve outlined most of these in our home improvement infographic but we’ve broken down the information here:

How loft conversions affect property values

A loft conversion is a large investment. On average, this can cost around £11,500. However, the benefits could be huge – adding an average 12.5% to the value of a home.

Buyers will always pay more for extra space and a loft conversion is an effective way to do this. However, in some cases, they can be difficult to implement and planning permission might also be required.

Therefore, a survey should be carried out to analyse how feasible this is before taking the plunge.

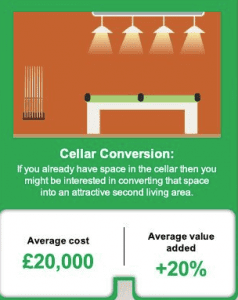

How a cellar conversion can add value to your home

If it’s too difficult to head up, maybe you can head down. If you have a large basement which is being used for storage, you might be able to convert this into an attractive living space. There is a lot of work to making this a viable option though and, on average, can cost around £20,000. However, if successful, a cellar conversion can add an average of 20% to the value of your property.

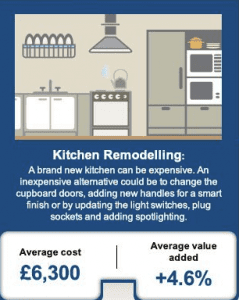

How remodelling the kitchen can increase the value of your property

Installing a brand-new kitchen is often an expensive prospect. However, a kitchen remodel could be a cheaper alternative to increasing property values. For example, changing the cupboard doors and adding new handles can give the place a smarter finish. On average, the cost of a kitchen remodel can come in at around £6,300. Yet, this could add an estimated 4.6 percent to the value of your home.

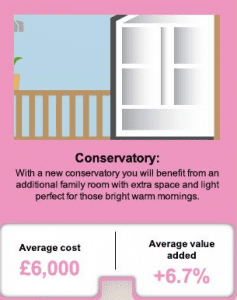

Add a conservatory to increase property value

If you’ve got the space, then a conservatory can be an excellent way to improve the value of your property. However, it is not without challenges. Planning permission might be required and you should decide whether this extension should be east or west-facing. Which direction you choose will determine if the conservatory is better suited as a breakfast room or as an evening living area.

Regardless, for an average cost of £6,000, a conservatory can improve the value of a property by an average of 6.7 percent.

Remodel the bathroom to improve property prices

The bathroom is perhaps the most important room in a home and remodelling it can be greatly beneficial to the overall value of a property. In fact, just keeping it clean and free of grime could be time well spent. Alternatively, remodelling the taps or installing a stylish sink can go a long way to making the bathroom a cheerier place.

On average, remodelling the bathroom can cost around £3,000. However, this could add an average of 2.9 percent to the overall value of your property.

Home improvements for under £1,000

We’ve dealt with some of the larger investments here but there are a variety of smaller jobs which can pay dividends. We’ve detailed some of these suggestions here.

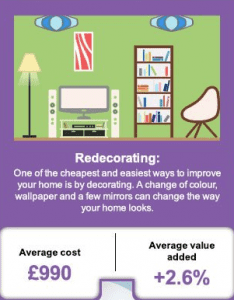

Redecorating and the effects on house values

It’s amazing what a lick of paint can do. However, don’t limit your redecorating to the inside of your home. Sprucing up the outside and tidying up the front lawn can make your property a much more attractive prospect.

Furthermore, if colours are fading, consider replacing them with a new coat of paint or wallpaper. Living areas and bedrooms should feature warm colours, hallways could benefit from neutral schemes, and bathrooms should have cool interiors.

On average, redecorating a home can cost around £990. However, it can add an average of 2.6 percent to the value of your property.

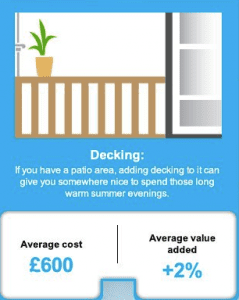

Decking can improve the value of your home

If you already have a patio area then some decking can go a long way to making it a more charming prospect. As long as you use a quality supplier and make the addition an attractive one, you could increase the value of your home as well.

For an average cost of £600, we estimate that the average value of your home could increase by around two percent.

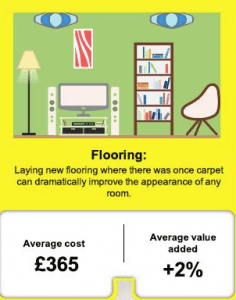

Boost property values by focusing on floors

Replacing carpets with wooden flooring can really make a difference when boosting property values. As long as this isn’t done excessively and uses quality supplies, strong and study wood can enhance the appeal of a room as well as benefit the bottom line.

In fact, spending an average of £365 on flooring could improve the average value of your home by around two percent.

How much value can my property gain?

In this guide we have looked at multiple ways you can improve the value of your home. From larger jobs to quick maintenance, the changes mentioned above should go a long way to affecting your bottom line. If you carried out all of these suggestions, we estimate the price of your home could increase by an average of 53.3% at a cost of around £48,000. Therefore, looking at 2017 average house prices, this means a typical home in the north west could gain around £83,000 in value. In contrast, a standard home in the south east may see its value increase by around £171,000.

Hidden elements which can affect property values

Although there are multiple ways to improve the value of your home, it is worth bearing in mind that there are some hidden factors which can adversely affect a property’s value. For example, these can include:

- Outdated plumbing/problems with water circulation

- Risk of subsidence

- Rude neighbours

- Damp

- Parking facilities

By bearing these in mind when conducting home improvements, we hope you won’t experience any nasty surprises!

Sources

- ‘Waitrose effect’ can ‘boost house prices by thousands of pounds’

- House prices rise 5% a year in more bad news for would-be-buyers

- Five ways to spot an up-and-coming area: The secrets of buying a property ahead of the house price curve

- UK House Price Index (HPI) for July 2017

- So How Much Do Conservatories Actually Cost

- Sam Dunn: ‘Will a basement conversion add value to my three-bed home?’

- How Much Do Double Glazing Windows Cost in 2017?

- The Evolution Money home infographic (see below)

Winter has arrived, which means we’re closing in on that special time of year when households up and down the country start thinking about whether or not to turn the heating on.

A warm, cosy house is an inviting prospect for all of us, of course, so you may be pleased to hear that it doesn’t necessarily need to result in weighty heating bills. Homeowners are constantly told to consider double glazing, or a heating system overhaul; but are there any quicker, less expensive ways to keep your monthly heating bills in check?

We’re here to run you through a few tips and tricks that could help to cut the cost of staying warm over the coming months – let’s dive straight in.

Review your insulation

A solid first port of call for any homeowner is to review their quality of insulation, particularly in the attic and cavity walls. People often do this manually by gaining access to the insulation through a small hole, or entry point, in an interior wall to check what has already been fitted.

Alternatively, many energy companies are happy to arrange an official review that will confirm what type of insulation is installed, and whether it is sufficient to prevent rapid heat loss. When fitted correctly, a comprehensive approach to insulation can shave hundreds off an annual energy bill.

Check for draughts

Beyond wall insulation, doors and windows play a huge role in any property’s ability to retain heat, so it makes sense to review any air leaks that may be causing cold around your house – before patching them up.

Start with a detailed inspection of each room. If you find that the border or stripping of a particular door or window is not sufficiently sealed then you’re likely to be losing valuable heat. A single threshold that isn’t properly insulated may not seem like much, but when more than one gap is left unchecked, that’s when you start feeling the draughts.

Localise the warmth

Many people are quick to switch on the heating for an entire house, even if they only need to heat a single room or space. Rather than relying solely on the boiler, you might be able to save a few quid by investing in a portable heater and putting it to use where necessary.

Sure, the remaining rooms in the house might be a little bit cooler, but the overall saving on gas often outweighs the additional electricity usage. Decent heaters tend to start at around £30 but the savings from the boiler should offset this cost and then some, particularly in the long run.

Invest in thicker curtains

While you may be committed to a particular colour scheme in your living room or bedroom, it’s always a good idea to have a backup pair of curtains ready to go when the temperatures start to drop.

This is especially the case if a house does not have double glazing installed throughout. In this case, a pair of curtains with a thick thermal lining is essential for those who want to retain as much internal heat as possible.

Shop around for a better rate

It’s no real surprise that the total price of our gas and electric bills tends to come to the fore of our minds during the winter months. This is usually the time when homeowners start thinking about the best possible deal they can get on their utilities.

There are plenty of comparison websites out there through which people can check how much, if anything, they are in line to save by switching. But before changing providers, it’s important to bear in mind that there may be certain cancellation fees for exiting out of a fixed rate tariff early.

Recently, the Bank of England made the decision to raise interest rates for the first time in ten year – an increase back to 0.5% from the historic low rate of 0.25%. This marks a signal of intent from the BoE’s monetary policy committee and ultimately means that the cost of borrowing is on the up.

So how exactly will this affect the average UK household? First of all, standard procedure will see this change in the base interest rate reflected on the high street, with most retail banks increasing their mortgage rate by 0.25% in line with the BoE.

For those people who are currently on a variable or tracker mortgage, this will see their monthly expenditure rise in the run-up towards Christmas. According to recent stats from Nationwide, this amounts to around 5 million British people, which works out to just under half of all mortgage owners across the country. It’s also worth remembering that the increase comes at a time when most homeowners are experiencing a freeze in their earnings, which will ultimately mean less disposable income to spend at the end of each month.

As you’d probably expect, the Bank of England’s decision has provoked plenty of reaction from economists and social commentators. Some experts say that, although there will be an expected dip in demand within the housing market, this suggests a fledgling indication of greater confidence in the economy that could have a positive impact in the longer term.

In fact, it’s perhaps our best indication in over a decade that the air of caution surrounding the economy since the credit crunch is beginning to turn around. Speaking to journalists off the back of the announcement, Governor of the BoE Mark Carney explained that the country was perfectly placed to handle the increase:

“To be clear, even after today’s rate increase, monetary policy will provide significant support to jobs and activity. And the Monetary Policy Committee continues to expect that any future increases in interest rates would be at a gradual pace and to a limited extent.

“Fully 60% of mortgages are now at fixed interest rates. Even with this Bank Rate increase, many households will refinance onto lower interest rates than they are currently paying by around 30 basis points for those moving from an expiring two-year fixed rate deal to around two percentage points for someone refinancing an expiring five-year fixed rates deal.”

If you’re still looking to clarify how your own mortgage may be affected by the interest rate increase, we recommend getting in touch with your local bank or building society.

Representative 22.93% APRC variable.

For a typical loan of £26,600 over 180 months with a variable interest rate of 19.56% per annum, your monthly repayments would be £484.00. This includes a Product Fee of £2,660.00 (10% of the loan amount) and a Lending Fee* of £763.00, bringing the total repayable amount to £87,030.00. Annual Interest Rates range between 11.7% to 46.5% (variable). Maximum 50.00% APRC. *Lending Fee varies by country: England & Wales £763, Scotland £1,051, Northern Ireland: £1,736.

Think carefully before securing debts against your home may be repossessed if you do not keep up repayments on your mortgage or any other loan secured against it. If you are thinking of consolidating existing borrowing, you should be aware that you may be extending the terms of the debt and increasing the total amount you repay.