Talking about money can be a difficult conversation, but how does it stack up against other awkward topics that we try our very best to avoid?

To find out, we conducted a survey that found out just how uncomfortable Brits are when it comes to talking about money.

According to a survey we conducted on 2,000 UK adults run in March 2022, it transpires that over half (52%) would go online for money advice around loans, debt, savings and money management – preferring this to talking with friends and family about these matters.

Furthermore, there are other conversations we’d rather have, with discussions about sex, politics, ex-partners and religion all considered preferable to talking about money for many.

Many would rather discuss anything but money

A shocking one in ten (10%) would rather speak to their parents about sex than money, and another 43% claimed that they would rather discuss politics or have a conversation about ex-partners (13%).

Over a third of those we spoke to (36%) would rather discuss politics with their grandparents than speak about money, and one in five (20%) would rather explain their relationship problems to their children than talk about any potential money woes.

Perhaps most astonishingly, one in five people (21%) would rather speak to their current partner about ex-partners, than discuss money matters with them!

On a regional level, those living in Northern Ireland turned out to be the people that are least comfortable talking about money, with almost half of those surveyed (44%) saying that they felt embarrassed, anxious, upset, or ashamed by the thought of it.

It gets easier to talk about money as we get older

One thing we can be thankful for is that according to our research, discussing money does become easier with age; 83% of 65+ year olds say that they are ‘happy’ to talk about their personal finances with their partner, compared to 64% of 25–34-year-olds.

In comparison, only 4% of 65+ year olds claim that they would feel embarrassed speaking to their partner about money, compared to double (8%) the amount of 35–44-year-olds.

These conversations are often better than expected

And despite us all worrying about these conversations, 71% of people even said that when they have finally plucked up the courage to have a discussion around money, it turned out to be fine.

One survey respondent told us: “I’m very open and will talk about anything. It’s good to share and get advice so it’s a positive.”

We sought professional advice from psychologist Dennis Relojo-Howell who makes it clear that being as open as possible regarding money and any associated issues is the best approach, as trusting others with this information can be rewarding and even help you receive the advice you may need.

The founder and managing director of Psychreg, explains: “Money matters can bring negative feelings such as embarrassment and guilt. Often, we avoid asking for financial help. This is because anything important in our lives is emotional. Our relationships are emotional, our work is emotional, and so is our money.

“When you experience financial difficulties, this can create some tension between you and family and friends. But when it comes to money, it is best to be truthful.”

Here to help

It’s perfectly normal to need help from time to time, whether that be advice from a family member or friend, or a financial product like a loan.

We may be able to help with a loan, you can apply online here. You can read the great things our customers have been saying about us here.

You can also get help and advice from Money Helper, go to moneyhelper.org.uk

Our research

The statistics featured in this piece came from a survey of 2,000 UK adults run in March 2022. The data was split by respondent age, gender and nearest city.

The top myths about borrowing money (and how to stop your money concerns)

The act of borrowing capital for it to be paid back with interest pre-dates even the common usage of money as a currency. Over the years borrowing, and the forces that govern it, have changed, and evolved.

Today, the lending industry is growing with institutions of all types, from breakdown recovery providers, to supermarkets.

With so many options available within such a crowded marketplace, certain myths have begun to circulate, myths that can be damaging to the people taken in by them. In this piece, we are going to highlight what we believe to be the top few, extract the truth from them, and hopefully leave you in a better position to eliminate your money concerns.

So, let’s kick things off with a classic…

Myth 1: If borrowing money, take the most that is offered to you

You need £500 for some emergency repairs on your car. You do your homework and find the loan company that fits your needs, fill out the form, and minutes later get a message telling you you’re eligible for a £2,500 loan. Happy days, eh? Now, not only can you get the repairs done, but you can have those chrome alloys fitted that you’ve had your eye on. You might even just have enough left over for a big night out to celebrate.

Easy there tiger. As tempting as it can be to get a little over-excited when seeing more numbers than you expected, it doesn’t mean you should take them all. Remember, loans companies tell you what you can afford to borrow, not what you should.

The bigger the loan, the higher the repayments. With this in mind, when deciding that you need a loan to finance any aspect of your life, do some number-crunching, work out exactly what you can afford to borrow; and stick to that figure.

Myth 2: Paying for everything yourself will ensure a good credit rating

Before approving a loan, lenders look at the borrowing history of a would-be customer. They need to ascertain how reliable they are when it comes to dealing with money, and how much of a risk a customer presents in terms of meeting repayments.

If no history can be found on a credit file because the individual in question pays for everything in cash, then it is difficult for a lender to determine whether it’s a risk worth taking.

Compared with using credit, or defaulting on repayments, using cash often presents as a superior option. However if you have only ever paid for everything outright and have no history of responsible credit use, then it will be make it harder to obtain credit should the situation arise.

Myth 3: A poor credit score can never be rebuilt

All a credit report really is, is a history of all your borrowing. A record of all credit opened in your name dating back no further than six years. Defaults, hard credit searches, and charges such as CCJs may all inflict damage on scores. Even if an account is closed, it isn’t wiped from your record, at least not for a long time.

But it’s not all bad news. It is possible to rebuild your rating by paying on time and showing yourself to be a good borrower.

Away from issues surrounding the pros and cons of saving, and of credit checks and paper over plastic, some of the most stubborn and prevalent myths surround independent loans companies. Up next are some of the most enduring…

Myth 4: Taking out another loan will just make my debt situation worse.

A lingering myth, and one which on the face of it looks obvious. Surely, if I’m struggling to meet multiple loan repayments, taking out another loan is nothing short of madness.

It’s a myth and allow us to explain why. By taking out a consolidation loan, all your existing debts are effectively paid off. This may mean no more letters from providers, no more trying to remember which days repayments are taken, and no more paying back multiple interest charges. The consolidation loan combines everything into one payment, taken on one day of the month, and at an interest rate that may be lower than any of those attached to the repayments you’ve been making.

And a little-known bonus is that if you manage to make your monthly payments and pay off the loan on time, it will actually end up improving your credit score. However, this may involve extending the lending terms of the loan increasing the total amount you may pay over time

Whatever you do though, don’t be tempted to seek loans from a secured loans provider, because we all know…

Myth 5: Secured loans providers insert hidden fees and conditions

There’s an entirely erroneous assumption that secured loans providers add fees and make changes to the original terms of loans after they have been approved. This is simply not true.

The most likely reason this myth persists, is that very few people bother to read every term and condition prior to taking out a loan. The reality is the UK loans industry is highly regulated. Lenders – all lenders – must include fees clearly and terms and conditions before a loan is approved, making it impossible for lenders to add fees and conditions once a loan has been taken.

The afore mentioned myths relating to secured loans providers work in unison to preserve another that will look familiar…

Myth 6: Secured loans providers are for people with serious financial problems

The smattering of bad publicity surrounding secured loans providers has followed a theme that such loans are the preserve of the destitute. *sigh* Not true. These loans are used for a variety of reasons like home improvements, or when credit scores mean the computer has said “no”. These can happen to anyone, regardless of income.

Just because you didn’t have access to your money immediately when an emergency expense arose. Or you just needed a little help because the emergency expense wasn’t budgeted for; doesn’t automatically mean you are struggling financially. It’s something most people have experienced at some point in their lives.

Evolution Money recently discovered that a whopping 86% of all recent funded loans were either for Debt Consolidation, or Home Improvements. Both hardly being the preserve of those on the bread line.

Should an emergency expense arise, advice from well-meaning third parties will play to the tune of our final myth…

Myth 7: You are better off without a loan from a secured loan provider

Some secured loan lenders may market their products aggressively. Then again, what industry isn’t pushing the benefits of their commodities with a degree of belligerence these days?

The point is demand for these loans continues to increase globally, not just in the UK. People, the world over, are turning secured loans providers, and are finding them quite useful, especially in emergency situations.

This myth has gathered pace because some secured loan provider customers have fallen foul of astronomic interest charges leveraged by a handful of rogue lenders (Source: https://www.theguardian.com/money/2007/sep/16/debt). As pointed out earlier, this is not typical. In fact, secured loans providers’ products are among the best, if not the best, types of short and long-term loans available today if they are taken wisely, used wisely, and repaid on time.

Christmas and New Year are an expensive time for most, after paying out for gifts, food, nights out with friends and visits to see family on top of your regular outgoings. It’s little wonder many of us are looking to save money in 2020 and cut our monthly expenses. Check out these 12 ways to help save money in 2020.

Use Public Transport

Okay so trains and other forms of public transport may not be as cheap and cheerful these days, but neither is paying to tax, M.O.T, insure, run and park a car. Using public transport can be a great way to save money in the New Year as well as possibly being the more eco-friendly option.

If you’re living in or around a bustling city, it’s likely you may save money by using public transport.

Buying your train ticket weekly, monthly, seasonal or even annually can prove to be a lot more cost-effective then single journeys, and there’s also plenty of hidden fares and split tickets up for grabs if you know where to look.

Consolidate your debt

If you’re paying off a debt, or even numerous debts, then you may be paying out a substantial amount of your income each month. Take control of your finances by consolidating your debt into one manageable monthly repayment and potentially save money each month.

It can also help you to gain a better understanding of your income and monthly outgoings, as you’ll no longer be juggling numerous due dates, lending terms and conditions. For a wide range of borrowing options, please take a look at our debt consolidation loans, ranging from £5,000 to £50,000, to see how Evolution Money can help you.

De-clutter, upcycle and sell your possessions

After the chaos of the winter holidays, it’s time to refresh, get your home organised, and of course, save. Why not spend some time de-cluttering, it’s a free activity at least, and sort through your possessions deciding what to keep, what to donate, and what to sell in order to bring in some extra cash.

You may even discover old clothes, like that jacket you only wore once to a wedding two years ago, and decide to re-wear or up-cycle. This can potentially help you to avoid the Early year sales and hoards of shoppers and actually save this month.

Shop Around for Services

Another way to save money and then benefit all year round is to make sure you shop around for your services. Do you have the best deal on utilities and household bills?

Could you be saving on your insurance?

Prices can vary wildly for the same service so you may be surprised that comparing service providers and swapping for a cheaper deal could help you to save hundreds of pounds over the year by cutting the cost of your monthly outgoings.

To potentially save on your broadband, media and mobile phone bills, contact your current providers and ask for a new tariff, you never know what you may be offered. Or, wait to renew your contract for a better deal with another provider. Sim-only contracts can often work out cheaper than paying for the handset too.

Install energy-efficient light bulbs

To save money on your household electricity bill this year, why not swap out your old lightbulbs for energy-efficient ones? LED light bulbs only use around 5 watts of power and work just as well, if not better, than filament bulbs that use around 40 watts. Upgrading even one bulb in your home could save you potentially hundreds over a lifetime as well as saving energy.

Try a Smart Meter

Try a smart meter to keep on top of your monthly electric and gas usage and costly outgoings. There’s plenty of advantages to using a smart meter over traditional meters including automatic meter readings and an in-home display so you can see how much energy you’re using and how much it costs you in real-time. That means no more estimated bills, and you’ll only pay for the energy you’ve used.

Ideal for when you’re trying to trim your outgoings and monthly bills. Start the year off the right way and save money on gas or electricity and minimise your use of appliances that are costly to run.

Unplug electrical devices when not in use

If you’re in the habit of keeping electrical devices plugged in around the house that you aren’t using, then 2020 is the time to stop and start saving some money.

It can sometimes prove difficult to keep on top of, especially in a house full of teenagers and numerous gaming consoles and gadgets. However, unplugging electrical devices when not in use could potentially save some money on your electricity bill.

Take a look at your Direct Debits

The start of the year is an ideal time to assess your outgoings and take a good look at your direct debts, memberships and subscriptions. You could save hundreds of pounds a year.

Whether it’s an expensive gym membership that you don’t make the most of, online streaming subscriptions you could live without, dating services you signed up to and lost interest in or free trials you forgot to cancel.

Plan Inexpensive Days Out

After splashing out on the festivities over the Christmas holidays, you’re likely looking to save on days out and activities in the new year. There’s no need to hide away though as there’s plenty of inexpensive days out and free activities.

Keep your eye on the community groups who often offer subsidised classes and activity days and free events for a range of ages. Why not swap a day at the zoo for a day at the park with a packed lunch? Check out the local leisure centre for a cheap swimming session or enquire at a volunteer group to find out how you could get involved.

Cook Homemade Meals

This tip for saving money in 2020 may be one of the more obvious ones and likely a new year’s resolution from a health perspective. We know there are many health and cost benefits to cooking homemade meals, and not living off ready meals or takeaways. There’s also the added benefit that taking last night’s leftovers into work for lunch will also stop you buying food every day and may end up saving you a considerable amount of money over the year.

Preparation is the key to tasty, cheaper homemade meals that will refrain you from eating out or ordering a takeaway. You’ll also be doing your bit to reduce waste.

Buy Items in Bulk when possible

When out shopping, buying items in bulk can be a great way of saving money in the long-term. When possible, take advantage of bulk buy offers on non-perishable and necessity items such as salt, rice and shampoo. Remember to only buy items that you need or would buy ordinarily.

You can also save money by choosing to buy supermarkets own-brand or basic products rather than the more expensive, well-known brands. Often there’s little difference in quality, only price, so there’s no reason for not changing your shopping habits and giving them a go.

Take Advantage of Coupons & Promotional Offers

You may be saving this month, but that doesn’t mean you can’t treat yourself once or twice. Take advantage of coupons and promotional offers in order to stretch your money as far as possible.

Plenty of restaurants offer up to 50% off at the start of the year to encourage customers to dine, and there’s plenty of coupons and discount codes available online for a wide range of days out and experiences. Check out voucher websites for before making any purchases.

Whether you’re looking for a cool cruiser, a sleek sports bike, or a zippy runaround, there are plenty of motorcycles to choose from. Not all, however, will be suitable for the beginner biker.

To help new riders find the right bike for them, this article explores a diverse selection of motorbikes to suit any budget.

1. Aprilia RS4 50

Designed specifically for young riders, the Aprilia RS4 50 is perfect for beginner bikers. Celebrated as ‘the superbike for 16 year olds’, the RS4 50 features a 50cc two-stroke engine, six-speed gearbox and a race-style rev counter with digital speedo, to offer the authentic experience of a sportbike.

Featuring Aprilia’s innovative technology, this racer replica can be a little expensive for a first bike – but it’s completely worth it. Be prepared to spend around £3,000 to get a second-hand one in good condition.

2. Honda Vision 50

If you’re looking for something to nip around town in, try the less powerful, yet equally as fun, Honda Vision 50. While it is technically classed as a scooter, the Honda Vision 50 is easy to ride, economical and reliable, making it perfect for city riding and commuting. You’ll also benefit from a spacious, comfortable seat which could easily fit two people, and thanks to its sleek shape and lightweight nature, the Honda Vision 50 easily conquers congested streets.

For a good-quality second-hand model, you’ll probably want to spend around £1,200, although you can get ones for as little as £450 if you’re on a strict budget.

3. AJS JSM 50

The AJS JSM 50 is a sporty scrambler-style bike, perfect for new riders seeking something thrilling, but not too powerful. Featuring an impressive six-speed gearbox and a 49cc two-stroke engine, this zippy, all-terrain looking bike is great for AM licence holders. Aesthetically, the JSM 50 is exciting, with its strong satin black alloy wheels and its vibrant, bold bodywork.

Stylish and affordable, you can buy one of these mean machines for around £1,700, depending on the condition.

4. Yamaha MT-125

Designed with young riders in mind, the Yamaha MT-125 is budget-friendly, reliable and extremely good looking. With a three-section digital dash which displays a clock, petrol gauge, trip time, mpg, distance to service and average speed, the MT-125 features everything a new rider could hope for.

Despite featuring a speedy yet not-too-powerful 125cc engine, the MT-125 boasts a ‘big bike’ feel and riding position with its naked chassis, athletic styling and wide-fitting handlebars. Depending on the condition of the bike, you can get a second-hand MT-125 for £2000 to £4000.

5. Kawasaki KLX250S

For someone seeking a little more power after passing their mod 2 test, the Kawasaki KLX250S features a 250cc, four-stroke engine and can be ridden legally both on and off-road. With a large, cushy seat and a natural riding position, this dual-sport bike is surprisingly quiet, comfortable and easy to ride.

While it’s not the most powerful off-road bike out there, the Kawasaki KLX250S can easily keep up with motorway traffic, as well as tear through mud with ease, climbs moderate hills and pull itself through deep sand – perfect for up-and-coming adventure bikers.

To get your hands on a second-hand model in good condition, look at spending anything from £3,250. If you want a real bang for your buck, the Kawasaki KLX250S is a great choice.

6. Harley-Davidson Street 500

The Harley-Davidson Street 500 is the perfect cruiser for bikers who are looking for something a little more laid-back, but still powerful. Since its release in 2014, the Street 500 and Street 750 have surpassed the Sportster and became the motor company’s go-to starter bike. Featuring a 492cc, liquid-cooled, ‘Revolution X’ v-twin-engine, the Street 500 was specifically designed to dominate the city streets and appeal to new riders.

While it is rather large and heavy for a 500cc, the cruiser offers a low-set seat which makes it easier for new riders who need to be able to reach the ground quickly. Reach to the bars is natural, with a relaxed seat position, making it an ideal cruiser for new riders with a smaller build, who are seeking a bike for city riding. For a second-hand Street 500, be prepared to spend around £5,000.

7. Honda CMX500 Rebel

Stylish, lightweight and fun, the Honda CMX500 Rebel is a novice-friendly cruiser featuring a reasonably powerful 471cc liquid-cooled, four-stroke engine. The Rebel is perfect for riders with a small build, thanks to its low seat and lightweight frame. Above all, it’s reliable, versatile and makes for a fun ride, especially suitable for cruising around town with ease.

The Honda Rebel is also available in 300cc – great for new riders who aren’t yet used to the power of a 500cc. As a side note, you’ll need an A2 licence to ride this beauty. Another budget-friendly cruiser, the CMX500 Rebel can cost around £4,000 or more depending on the condition of the bike.

8. Suzuki Bandit 600

The Suzuki Bandit is an ideal starter bike for those looking for a more powerful ride with the promise of reliability. First released in 1995, the Bandit was one of the first budget middleweight bikes, coming after Yamaha’s Diversion which was launched in 1991. In fact, the Bandit was considered the better of the two bikes because it was significantly cheaper, good looking, and served its purpose perfectly as a speedy yet budget-friendly bike.

With a top speed of 125mph, the Bandit is not only fast, but it handles well – which is great for new riders learning to handle a more powerful bike. Nowadays, Suzuki Bandits range from £600 to £2000 depending on the condition – an excellent price for such a powerful bike.

9. Suzuki SV650

Featuring a 645cc V-twin engine, the Suzuki SV650 is powerful but not quite enough to intimidate a new rider. In fact, the bike offers an impressively smooth ride and is moderately lightweight, making it easy to handle.

Featuring a Low RPM Assist helps avoid stalling, which is great when you’re a new rider. Practical and comfortable, the Suzuki SV650 features an upright riding position while still maintaining a very sporty feel. As a bonus, the Suzuki is fuel-efficient with an average of 48mpg.

You can get your hands on one of these beauties for around £3000 – £6000, depending on the condition.

10. Triumph T120 Bonneville

At a glance, you may not think that the Triumph T120 Bonneville would be a suitable bike for beginners, but take a little time to get to know the ride, and you’d be wrong. Fitted with a powerful 1,200cc twin-parallel high torque engine, the T120 Bonneville has plenty of power to get you where you need to go without fuss. As a cruiser, the T120 is powerful enough to be fun without the fear factor.

With a mid-range, surprisingly comfortable seat, you get a good balance between control and a relaxed riding position. As with many of Triumph’s classic creations, the T120 Bonneville boasts a timeless beauty with its handcrafted chrome detailing, heated grips, and 160 available accessories.

Costing anywhere between £8,000 – £11,000 depending on the condition, the T120 Bonneville may be slightly more expensive than the other beginner bikes listed here, but it definitely makes up for it in performance.

Secured Motorcycle Loans at Evolution Money

Whether the Vision or the Bandit has caught your eye, or you’re hoping to keep your options open by buying and insuring more than one bike, finding your first motorcycle can be difficult. For beginner bikers, the more research you conduct and the more experience you gain from handling and trialling different bikes, the more informed your decision.

Also, for those concerned with affordability, at Evolution Money, we’re able to offer motorbike loans to help you buy your ideal bike. Our motorbike loans range from £5,000 up to £50,000.

We take your personal circumstances into account and offer affordable repayment rates to suit you. For more information on secure motorcycle loans at Evolution Money, contact our qualified loan advisors at Evolution Money today for a no-obligation quote on 0161 814 9158.

Typical usual statements will be contained within the footer that is displayed on every page on the website

What’s Been Happening?

In the closing months of 2018, a number of high-street banks across the United Kingdom were hit with significant IT failures that impacted customers’ ability to access online services.

In the UK, for the last few years at least, we’ve been constantly bombarded by the press about the growing online threats of hacking and data theft. However, as banks rush to make the necessary improvements to their IT infrastructure, it’s being increasingly noticed that customers are finding access to their own cash can often become impaired during the process; in some cases, people have even missed important payment deadlines despite them having the required money in their accounts.

According to Which, banks in the UK are affected by serious IT failures and outages on a daily basis. From the 1st of April 2018, through to the end of the year, Which discovered that exactly 302 reports were filed by 30 of the UK’s major banks and building societies regarding serious IT failures – this averages out at roughly one incident a day!

Barclays reported the largest number of major incidents, at 41 over the investigated period. This was closely followed by Lloyds Bank with 37, Halifax/The Bank of Scotland with 31, NatWest with 26, RBS with 21 and the Ulster Bank with 18.

Furthermore, ClearScore recently conducted an eye-opening survey, specifically targeting individuals affected by these banking service outages. The results of this survey highlight the significant impact service outages have had upon banking customers; of the 2,000 people interviewed for the survey after experiencing a service outage, roughly 67% found errors in their credit history.

However, it appears that many more mistakes might be sailing under the radar; data suggests that roughly only around a quarter of banking customers actually think to check their Credit Scores after service outages. Additionally, a third of customers have never even considered checking their Credit Score – regardless of whether or not they’ve experienced a service outage.

How Does It Affect Me?

If online services are impacted by outages, people can be left unable to make important payments – leading them to miss payment dates. Missing payment dates can have a significant impact upon a customer’s credit score, and this is especially unfair to customers who’ve had the money in their accounts but were unable to access it.

In some cases, defaulting on an important payment may incur costly late payment fees. Such fees can have staggering effects on customers with irregular streams of income; you could potentially be pushed over your credit limit or into your overdraft, both of which have a chance of damaging your credit score further. Worryingly, having a poor credit score can often affect your ability to qualify for a new mobile phone contract, a loan or even a mortgage.

If you’re worried that your credit score might have been adversely affected as a result of a banking service outage, feel free to check your credit score out now using an online service.

What Should I Do If I’ve Been Affected?

If you’ve spotted an error in your credit score that was most likely caused by something outside of your own control, here’s what you can do to fix it:

Talk to the Bank, Company or the Lender

Ideally, your first stop when trying to fix a credit inaccuracy error should be to contact the company or lender who you’ve been unable to pay because of the service outage. Many companies and lenders will likely be happy to amend the error immediately; however, you should be prepared to go through your company’s, or lender’s, official complaints procedure.

Talk to the Relevant Credit Reference Agencies

As your credit score is a reflection of your financial behaviour, and also belongs to you, it’s important to ensure it’s accurate. You therefore have the right to dispute any information it contains if you think it is incorrect.

If the company, or lender, is unwilling to address the problem, you may have to go directly to one of the UK’s three Credit Reference Agencies: Experian, Equifax or TransUnion. Experian, Equifax and TransUnion all have online forms you can complete that will allow you to raise a query concerning late payments due to bank IT outages. In order to settle the dispute, the Credit Reference Agencies will investigate the issue and contact all related parties.

If the company or lender you are having trouble with fails to agree with your assessment of the events, there’s no need to feel hopeless – a Notice of Correction can also be applied to your credit score file. A Notice of Correction is typically a 200-word explanation of the events from your perspective, usually describing how this incident isn’t reflective of your usual financial behaviour.

How Do I Improve My Credit Score?

A person’s credit score should represent an accurate record of their financial history. There’s no need to worry though if you have a low credit score from prior circumstances – there’s plenty you can do right now to begin to improve it.

Whether it’s by ensuring you’re registered with the electoral roll at your current address, or by applying for a credit-building credit card, there are multiple ways you can begin to rebuild your credit score. For some top tips on how to repair your credit score, check out our fantastic blog post on improving your credit score.

1# https://www.which.co.uk/news/2019/03/revealed-uk-banks-hit-by-major-it-glitches-every-day/

2# https://www.which.co.uk/news/2019/04/two-thirds-of-people-find-credit-score-errors-after-bank-it-failures/

The Premier League 2019/20 season is now in full play and recently transferred players, up and down the UK, have started to settle in to their new teams.

A recent study by Evolution Money has revealed which UK towns and cities have produced the most valuable talent of all the UK-born players, playing in the 2019/20 Premier League season.

The capital boasts the lion’s share of valuable players, with the market value of London-born players reaching an impressive, £503.64m. There are 39 players in this seasons Premier League hailing from London, making London the UK’s largest producer of football talent.

Despite having such a large pool of players contributing to London’s market value, one star player contributes a huge 25 percent of the total market value for the city. Walthamstow born, Tottenham Hotspur forward, Harry Kane, currently boasts a market value of £135m, making him the highest valued player in the league.

Following London, in places two to five, are four cities located in the North of the UK; Liverpool (£141.16m), Sheffield (£128.25m), Manchester (£127.12m) and Glasgow (£81.45m).

Both Liverpool and Manchester have produced players with a current market value of a striking £72m. Marcus Rashford, from Manchester and Trent Alexander-Arnold, from Liverpool, are each responsible for over 50 percent of their cities market value. Both also play for teams in the cities they were born, Manchester United and Liverpool FC.

Robin Russel-Fisher, Finance Director at Evolution Money, said: ‘’It’s really interesting to see which UK towns and cities have produced the hottest players in this season’s Premier League and it’s great to see that the talent comes from all across the country.

As a Manchester founded company, we were particularly pleased to see that Manchester made it into the top five.”

At Evolution Money, we understand that people can need a helping hand with their finances from time to time, that’s why we offer convenient and flexible financial solutions to our customers throughout the UK.

Some of the towns and cities with a place in the top 15 have earned their spot with the value of just one player. Milton Keynes, in position seven, has produced only one player currently playing in the Premier League, Dele Alli, however Alli has a current market value of an incredible, £81m. The northern town of Barnsley also has only one homegrown star in the Premier League this season, John Stones, with a market value of £54m, putting his town in position 11.

In the internet age, we have access to more information than ever before. However – while this technology has proved greatly beneficial – it has also led to a variety of problems. For example, ‘fake news’ is not just limited to media coverage but also spread to how we process information.

This includes how we manage our finances. Navigating this world can be challenging to begin with but there is so much misinformation about credit scores out there that we keep hearing the same myths again and again.

Hopefully, we can now put some of these falsehoods to rest while clarifying those which will have any sort of impact on your credit score.

Your credit score explained

First, let’s explain what your credit score actually is. While we’ve covered this in detail within our help and advice section, your credit score basically indicates how much of a potential risk you could be to lenders.

The higher your credit score generally is, the more responsible you will appear to these organisations. Negative elements such as missed bill payments, multiple credit cards, or county court judgements can reduce this figure and might prevent you from obtaining certain financial products.

We also have a range of hints and tips if you want to repair a poor credit score.

Top myths about credit scores

Although there’s a substantial amount of information out there related to credit scores, we continue to hear inaccuracies about what influences these figures. We’ve detailed those we hear most often below:

Every person has one credit score

False. Nobody has a single credit score or rating that is used to assess their eligibility for credit; instead, credit checks are completed at the discretion of each credit provider. This means that people can have multiple scores at any one time, depending on the individual criteria of each agency.

These credit scores vary as different agencies operate on unique scoring models. Regardless, the higher these figures are, the better financial products you should have access to.

Previous occupants of your house can affect a credit score

False. It’s a common misconception that the previous occupant of your property can impact your credit score, or that the credit history of a particular house somehow passes over to the next person who moves in.

These days, credit checks are conducted on individuals, rather than addresses. In most cases, your personal credit score does not factor in the financial situation of others, unless you have received approval for a joint credit application or are financially associated with another person.

Never borrowed money? You will have a good credit score

False. Although it’s logical to think that if you’ve never had the need to apply for credit then you must have a tight handle on your finances, this doesn’t necessarily mean you will have a good credit score.

When assessing any application for credit, most lenders are keen to see evidence that a person has borrowed money in the past and has been able to pay it back on time. Many people look to solve this issue by taking out a credit card, not because they need the extra funds, but because they can use it to build a history of well-managed credit repayments.

Bad credit lasts forever

False. Many people are worried about the future impact of their credit decisions, particularly if they have missed repayments in the past.

The good news is that credit checks are designed to be an accurate and detailed picture of a person’s current financial situation, and so the majority of lenders will only take into account credit information within the past six years.

Checking your credit report harms your credit score

False. Checking your credit report will not adversely affect your credit score. Although there are paid and free ways to do this, you can request this check as many times as you like to observe fluctuations in your score.

When lenders are assessing how much of a potential risk you are, they will take into consideration the applications for financial products left on your report. Events such as a soft credit enquiry (when credit is not investigated as part of a lending decision) or checking your credit score will not factor into this analysis.

Therefore, as long as you are not routinely applying for products in order to determine your score, you won’t be adversely affected by making regular checks.

Employers can check your credit score

False. One of the most prevalent myths about credit scores states these figures can be reviewed by an employer. This is not true and the problem likely arises from individuals using the phrases ‘credit report’ and ‘credit score’ interchangeably.

Although an employer can review your credit report, this differs from the one typically seen by lenders and is often used to indicate how financially responsible a worker is – especially so if the job requires handling large amounts of funds.

Furthermore, he or she cannot do this on a whim. If an employer seeks to review your credit report (not all employers would want to) you must give written consent.

You can be on a credit blacklist

False. There is no such thing as a credit backlist. We can assume that if such a document did exist (and you were on it) you would be banned from borrowing funds and find it extremely difficult to be removed.

If someone is turned down repeatedly for financial products, he or she might assume they are on a blacklist – which is probably how the rumour started. However, there are lots of factors which can influence how likely an application is to succeed.

If that individual worked on improving their credit score, they would soon realise that they haven’t been blacklisted by lenders at all.

When applying for a loan, mortgage, or credit card, your credit score will typically be evaluated to determine how safe a borrower you are. During the check itself, a variety of potential factors will be reviewed. These could include:

- Your name and date of birth.

- The value and length of any loans, credit cards, or mortgages taken out in that person’s name.

- The conduct of these loans. For example, highlighting if any payments were missed.

- Your history of utility bill payments, phone bill payments, and other bills.

- Your history of previous loan applications.

- Your payment profile – if there have been any late payments or if payments have been made on time.

Depending on what credit score you have, this will have a bearing on what sort of financial products you can obtain. Those with an extremely low credit score may struggle to gain access to any sort of loan – or might be required to pay higher rates.

What is a bad credit score?

When lenders are evaluating credit scores, they will do so against a scale. Although variations exist across agencies, Experian’s scale ranges between 0 and 999. Under those measurements, a score of 881 or more is classified as ‘good’. A credit score under 720 though is described as ‘poor’.

When determining these scores, certain aspects of a person’s history will have greater weighting than others. For example, according to Experian, the most important factor is an applicant’s payment history – making up around 35% of the total score.

Regardless, if your credit score falls within the ‘poor’ range, this is no cause for despair. The good news is these ratings can be improved with some hard work.

How to fix a bad credit score

The first step to fixing a poor credit score is determining where the problem lies. As mentioned earlier, this rating takes a variety of factors into account so learning which one negatively affects your score is a great step in the right direction. Therefore, before doing anything, you should request to view your credit report.

Once obtained, you should review it in detail to determine that the information is accurate.

The importance of fixing inaccuracies

Although inaccuracies might include basic errors, such as incorrect address details, reviewing this report can also identify fraudulent activities.

If someone has made an application for a loan in your name, then this could have a detrimental effect on your credit score. Although this should be reported immediately, other mistakes ought to be highlighted to the organisation which supplied the original information.

You may also choose to add a ‘notice of correction’ as a way to highlight extenuating circumstances. For example, hospitalisation preventing you from working and, therefore, causing you to miss a mortgage payment.

How else can I improve my credit score?

Once you’ve determined how accurate your credit report is, you can begin to take steps to improve it. Fortunately, they are a variety of ways you could do this:

- Paying bills on time. It sounds obvious, but this is a great way to demonstrate your trustworthiness to potential lenders.

- Resolve your debts. It is advisable to clear your debts before taking on additional finances as well as closing any unused credit cards. Clearing this may make you more attractive applicant to some lenders.

- See who you share accounts with. You might have a spotless credit history, but does your spouse? If your credit report is linked with a person who has a poor credit score, you might find it harder to obtain a good deal. In this situation, that individual could benefit by taking some of the steps mentioned here.

- Reduce the number of credit cards. Having too many cards may be seen as an inability to effectively manage your finances without resorting to multiple credit options.

- Get on the electoral register. This is important as the electoral register is one of the best ways for lenders to check/confirm your information.

- Build your credit history. Even if you have no debts, you might have a poor credit score as there is no record of responsible payment. In this situation, applying for a credit card or credit-builder loan could help rectify this.

- Seek advice from the Money Advice Service, an independent service set up to help people manage their money.

How long will it take to improve my credit score?

Sadly, there is no quick way to do this. Potentially, it might take months or even years before you improve your credit score. However, in many ways, this can be viewed as an opportunity.

Improving a credit score is a marathon, not a sprint. Much like how the best runners don’t immediately start with a challenging event, taking small steps now will likely yield more positive results in the future.

Therefore, start slow. Understand the points in your credit report and strive to improve these one at a time. Alternatively, if your debts are getting on top of you, consider professional advice or consolidating your loans into affordable monthly repayments.

Whether you plan on selling your house in the near future – and want to set a higher asking price – or you simply need a bit of a change in your day-to-day living, there are plenty of options to consider when it comes to home improvement.

Of course, every person or family has their own distinct priorities. You may need to replace a faulty oven, create more space within the house, redecorate a particular room, or even transform the garden into a liveable space. While any increase in total market value depends on how much you choose to invest in the first place, everybody can do a few things to get the ball rolling. In this guide, we will look at some of the factors which can influence property value as well as suggest a few small tweaks which can go a long way.

How can location affect the value of my home?

First, let’s focus on something you can’t change – where your home is based. The effect of location on property values can vary depending on a number of external factors. For example, living in an area with an excellent local economy which features a good community spirit can do wonders for property prices. In a similar fashion, if a school is due to be built near you, the value of your home could increase.

One report, published in the Independent, highlighted the effects of having a supermarket on your doorstep. According to the report, living near a Waitrose could add more than £36,000 to the value of a home. In fact, being in close proximity to any major supermarket may improve property prices by approximately £22,000.

This has lead to some individuals describing this as the ‘Waitrose effect’.

In 2017, an article in the Guardian highlighted the areas of the UK where property prices were increasing. Over a 12-month period, the North West saw the greatest hikes with a seven percent gain in house values. In contrast, the value of homes in London had a regional increase of 2.5%.

Therefore, although you can’t change where your property is based, there are external factors which can affect its value. As well as spotting the addition of amenities such as a supermarket, This is Money has highlighted other factors.

For example, according to the organisation, the arrival of niche food chains – such as delicatessens – can be a sign that the local population is becoming more affluent and will have more disposable income.

Furthermore, an increasing youth population can be positive. Afterall, the publication argues, the majority of these will be young professionals who require access to transport links and local businesses. As a result, this demand will bring these organisations to the area and improve the area – increasing house prices as a result.

However, be aware that you won’t be the only one looking for these indicators. Anecdotally, there are stories of house visits turning into queues of potential buyers. As a result, these desirable properties can go for much higher than the original asking price.

Therefore, it requires plenty of foresight – and a bit of luck – to benefit from these changes.

How can I improve the value of my home?

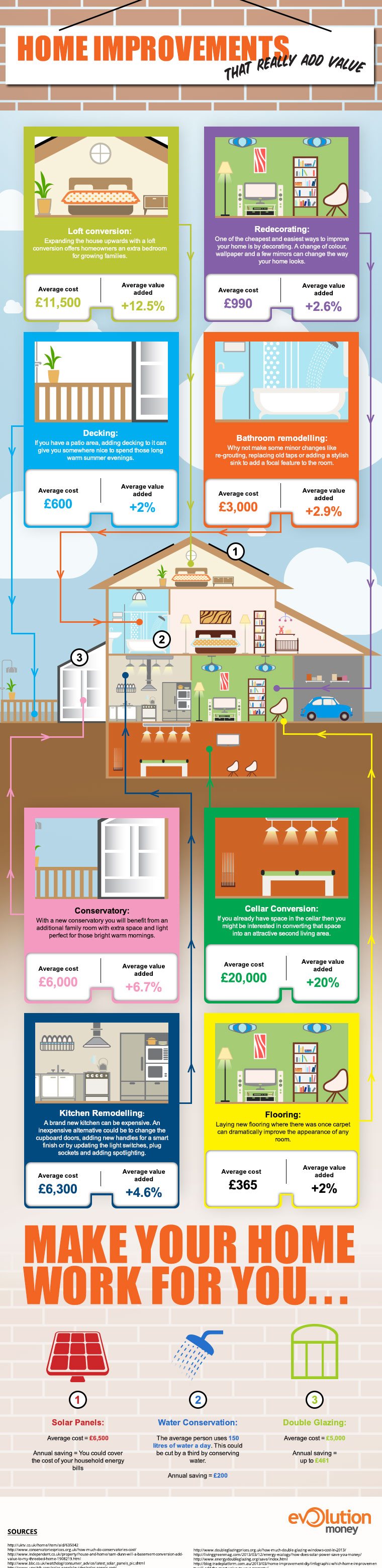

Although location is an area you won’t have much influence over, there are lots of elements you can control. We’ve outlined most of these in our home improvement infographic but we’ve broken down the information here:

How loft conversions affect property values

A loft conversion is a large investment. On average, this can cost around £11,500. However, the benefits could be huge – adding an average 12.5% to the value of a home.

Buyers will always pay more for extra space and a loft conversion is an effective way to do this. However, in some cases, they can be difficult to implement and planning permission might also be required.

Therefore, a survey should be carried out to analyse how feasible this is before taking the plunge.

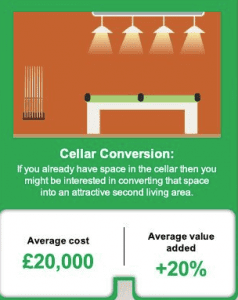

How a cellar conversion can add value to your home

If it’s too difficult to head up, maybe you can head down. If you have a large basement which is being used for storage, you might be able to convert this into an attractive living space. There is a lot of work to making this a viable option though and, on average, can cost around £20,000. However, if successful, a cellar conversion can add an average of 20% to the value of your property.

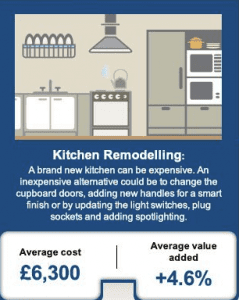

How remodelling the kitchen can increase the value of your property

Installing a brand-new kitchen is often an expensive prospect. However, a kitchen remodel could be a cheaper alternative to increasing property values. For example, changing the cupboard doors and adding new handles can give the place a smarter finish. On average, the cost of a kitchen remodel can come in at around £6,300. Yet, this could add an estimated 4.6 percent to the value of your home.

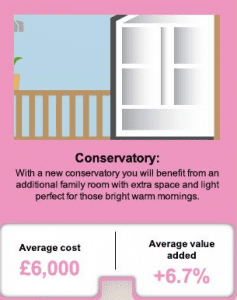

Add a conservatory to increase property value

If you’ve got the space, then a conservatory can be an excellent way to improve the value of your property. However, it is not without challenges. Planning permission might be required and you should decide whether this extension should be east or west-facing. Which direction you choose will determine if the conservatory is better suited as a breakfast room or as an evening living area.

Regardless, for an average cost of £6,000, a conservatory can improve the value of a property by an average of 6.7 percent.

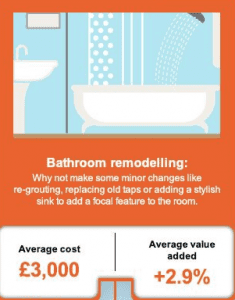

Remodel the bathroom to improve property prices

The bathroom is perhaps the most important room in a home and remodelling it can be greatly beneficial to the overall value of a property. In fact, just keeping it clean and free of grime could be time well spent. Alternatively, remodelling the taps or installing a stylish sink can go a long way to making the bathroom a cheerier place.

On average, remodelling the bathroom can cost around £3,000. However, this could add an average of 2.9 percent to the overall value of your property.

Home improvements for under £1,000

We’ve dealt with some of the larger investments here but there are a variety of smaller jobs which can pay dividends. We’ve detailed some of these suggestions here.

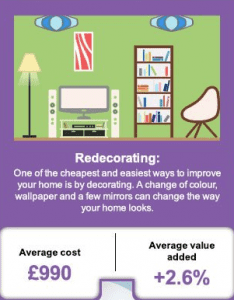

Redecorating and the effects on house values

It’s amazing what a lick of paint can do. However, don’t limit your redecorating to the inside of your home. Sprucing up the outside and tidying up the front lawn can make your property a much more attractive prospect.

Furthermore, if colours are fading, consider replacing them with a new coat of paint or wallpaper. Living areas and bedrooms should feature warm colours, hallways could benefit from neutral schemes, and bathrooms should have cool interiors.

On average, redecorating a home can cost around £990. However, it can add an average of 2.6 percent to the value of your property.

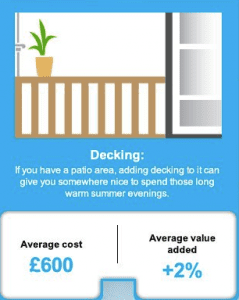

Decking can improve the value of your home

If you already have a patio area then some decking can go a long way to making it a more charming prospect. As long as you use a quality supplier and make the addition an attractive one, you could increase the value of your home as well.

For an average cost of £600, we estimate that the average value of your home could increase by around two percent.

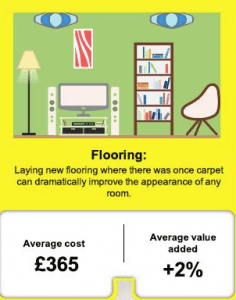

Boost property values by focusing on floors

Replacing carpets with wooden flooring can really make a difference when boosting property values. As long as this isn’t done excessively and uses quality supplies, strong and study wood can enhance the appeal of a room as well as benefit the bottom line.

In fact, spending an average of £365 on flooring could improve the average value of your home by around two percent.

How much value can my property gain?

In this guide we have looked at multiple ways you can improve the value of your home. From larger jobs to quick maintenance, the changes mentioned above should go a long way to affecting your bottom line. If you carried out all of these suggestions, we estimate the price of your home could increase by an average of 53.3% at a cost of around £48,000. Therefore, looking at 2017 average house prices, this means a typical home in the north west could gain around £83,000 in value. In contrast, a standard home in the south east may see its value increase by around £171,000.

Hidden elements which can affect property values

Although there are multiple ways to improve the value of your home, it is worth bearing in mind that there are some hidden factors which can adversely affect a property’s value. For example, these can include:

- Outdated plumbing/problems with water circulation

- Risk of subsidence

- Rude neighbours

- Damp

- Parking facilities

By bearing these in mind when conducting home improvements, we hope you won’t experience any nasty surprises!

Sources

- ‘Waitrose effect’ can ‘boost house prices by thousands of pounds’

- House prices rise 5% a year in more bad news for would-be-buyers

- Five ways to spot an up-and-coming area: The secrets of buying a property ahead of the house price curve

- UK House Price Index (HPI) for July 2017

- So How Much Do Conservatories Actually Cost

- Sam Dunn: ‘Will a basement conversion add value to my three-bed home?’

- How Much Do Double Glazing Windows Cost in 2017?

- The Evolution Money home infographic (see below)

When Chancellor Philip Hammond announced the first economic budget of his tenure back in March, many people were of the opinion that he was trying to steady the ship wherever possible in the aftermath of Brexit. In which case, any big changes to fiscal policy were to be postponed until later in the year.

Last week saw Hammond unveil many of those changes to the House of Commons as part of his autumn budget. While his focus on increased funding for education – particularly digital skills, computer science and maths – is certainly positive, it’s hard to mask the underlying theme of damage limitation.

For those unfamiliar with GDP targets, the UK’s official economic target is to achieve 2% growth each year. This is actually the first budget in modern record that the Chancellor has forecasted less than 2% growth in any one of the next five years. If there’s any clear signal that the British economy is failing to meet long-term productivity standards, this is it.

How will the budget impact you?

Despite the bigger picture looking slightly bleak for the country as a whole, the majority of taxpayers will find themselves keeping a few extra quid in their pocket at the end of each month. This is due to the personal allowance increase of £350 – up to £11,850 – which will come into effect in April 2018.

As for pensioners and other non-tax payers, the net increase will be lower, although they do stand to gain an extra £8 per month following the changes. This is with the exception of some married pensioners, who stand to gain as much as £57 per month. However, it’s worth bearing in mind that these increases must also be weighed up against inflation and rising prices for household goods.

As always, housing also remains one of the country’s main concerns. Chancellor Hammond addressed the issue head-on, explaining that not enough homes are being built but that there is no simple, short-term solution to the problem. Instead, long-term changes to planning regulations, construction legislation and policies at local council level are needed.

It looks like we may have a challenging few years ahead.

Representative 28.96% APRC (Variable)

For a typical loan of £26,600 over 180 months with a variable interest rate of 19.56% per annum, your monthly repayments would be £484.00. This includes a Product Fee of £2,660.00 (10% of the loan amount) and a Lending Fee* of £763.00, bringing the total repayable amount to £87,030.00. Annual Interest Rates range between 11.7% to 46.5% (variable). Maximum 50.00% APRC. *Lending Fee varies by country: England & Wales £763, Scotland £1,051, Northern Ireland: £1,736.

Think carefully before securing debts against your home may be repossessed if you do not keep up repayments on your mortgage or any other loan secured against it. If you are thinking of consolidating existing borrowing, you should be aware that you may be extending the terms of the debt and increasing the total amount you repay.