Manchester-based secured loan provider Evolution Money has been ranked 29th on this year’s annual Sunday Times Virgin Fast Track 100 list.

Published annually since 1997, the Sunday Times Fast Track 100 ranks Britain’s private companies with the fastest-growing sales and provides a definitive league table of companies in the UK by their rate of growth.

Founded in 2011, Evolution Money has seen a substantial 90% increase in sales over the past three years. Having moved to a new office space on Portland Street, the firm now employs over 100 people and has set its sights on matching that growth over the coming years.

Steve Brilus, CEO of Evolution Money, said of the announcement: “Evolution Money are delighted to have been featured in the most recent Sunday Times edition Annual Virgin Fast Track 100, as being the 29th fastest growing private company in the UK.

“Clearly we are extremely pleased to have achieved this and we are fully appreciative of the role all of our staff, investors and customers have played. We are looking forward to continued strong growth over the next three years and beyond.”

In order to qualify for inclusion in the Fast Track 100 list, companies have to be registered in the UK and be independent, unquoted and ultimate holding companies. Sales growth is measured by compound annual growth rate (CAGR) over the last three financial years.

Evolution Money forms part of Darwin Loan Solutions, alongside its sister company Progressive Money.

With another Black Friday just past, we take a look at the origins of this relatively new tradition and how it has become an ingrained marker for the start of our festive splurging.

The concept was first introduced by American retailers keen to capitalise on the Thanksgiving holiday, a time when many people are off work and looking to shop for presents in the build up to Christmas. Big chains like Walmart and online retailers such as Amazon started the trend, which has continued to snowball every year for the past decade.

Having gradually made its way across the pond, the Black Friday tradition has well and truly set up stall in the UK. This day has once again shown that more and more retailers are embracing the idea, but are extending the discounts for the entire weekend rather than just a single day.

Black Friday goes digital

However, if this year has taught us anything it’s that there’s beginning to be a slight shift in attitude, with less brawling in the department store aisles and more online bargains popping up across the web.

In an increasingly digital world where people can now browse and buy items within a few clicks on their mobile, perhaps future Black Fridays will see retailers investing more in their online presence and less on front door security.

A classic marketing ploy

Don’t forget that Black Friday is designed by retailers for retailers, particularly those looking to sell more electronic goods like TVs, laptops and video game consoles.

It’s unlikely that customers will keep tabs on the sale of electronic goods at other times of the year, which means we are left to assume that the Black Friday deals are by far the best out there. Not necessarily. Often there’s not too much difference in price, if any.

So, if you feel like you’ve missed out on the best bargains, or if you’re planning on rushing out to the shops next year, make sure you do your research and don’t spend for the sake of it.

Cast your mind back to 1996.

Dolly the sheep is the first mammal to be cloned. Prince Charles and Princess Diana announce their divorce. England host the European Football Championships and, of course, the lads from Take That went their separate ways for the first time.

In London, the average worker earned approximately £22,000 per year. Prices were relatively steady in the housing market following the recession in 2008, and the average house cost around £79,000 – four times a person’s annual salary.

How times have changed

Fast forward to 2016 and things are significantly different. The average house price now stands at a whopping £488,908, a 518% increase from 1996, and first-time buyers can expect to pay a deposit of £96,000.

Perhaps even more shocking is the correlation between the house price increase and the average wage increase. A person working in the capital today earns approximately £36,000, which is an increase of just 66% from 1996. Compare that to the 518% increase in house prices and it’s easy to see the disparity in affordability.

‘Generation Rent’

Unsurprisingly, such a large rate of inflation over the past 20 years has impacted heavily on the city’s residents. In 2001, figures show that just 15% of Londoners rented their property, and the likelihood was that after a few years you’d be able to save up enough to afford a small flat.

These days, approximately one in three of the capital’s residents rents, with many believing that purchasing a house in the capital is getting further and further out of reach.

This has had a clear impact on London’s demographic: there is still a large influx of young professionals, but there are now more and more people in their 30s and 40s choosing to leave the capital in order to secure a more affordable property.

How long the prices can keep rising for, only time will tell. It’s certainly a good time for those residents of London who have managed to pay off most, if not all, of their mortgage.

With just under six weeks to go until the big day, it’s safe to say that the festive season is now well and truly upon us!

And despite our best intentions to put away enough money to cover all the extra expenses – presents, food, drink, decorations, tree and turkey – it’s really difficult to anticipate the total cost, particularly if you’re catering to a fairly large family.

According to international internet-based market research firm YouGov, the average British household will spend a whopping £796 on Christmas this year. That’s a lot of mince pies!

Considering a Christmas loan?

It’s no surprise that we hear from so many people around this time of year who are in need of a little extra cash during the Christmas holidays and as we enter the new year.

If funds are tight, a secured Christmas loan through Evolution Money could prove to be an excellent solution. Our loans are tailor-made to suit your personal requirements and start at £1,000. Even if you don’t have a spotless credit history, our secured loan experts take into account your whole financial situation before making a decision.

If you’re worried about your spending this Christmas then there are plenty of things to keep your bank balance in check. Have a read of this article we recently put together for some quality saving tips.

Remember the old saying: when America sneezes, the rest of the world catches a cold.

Well, with Donald Trump now due to take his seat in the White House this coming January, the global economy has its tissues ready for a period of economic and financial uncertainty.

It remains to be seen how the relationship and exchange rate between the US and Britain will be affected in the long run – whether Trump seeks to make good on the ‘special relationship’ he’s spoken about, or maintain his stance against American free-trade policies.

But in similar circumstances to the UK’s decision to leave the EU earlier this year, we’ve already seen the value of the pound fluctuating in response to this week’s election results.

Planning a trip to the US soon?

Sterling is currently performing strongly against the dollar, so if you’re planning a trip to the US in the near future then now could be a prime time to get your pounds changed into dollars.

The same goes for holidaymakers who are planning a trip to Mexico in the near future. The pound has strengthened by nearly 10% against the Mexican peso in the past few days, so getting your money exchanged sooner rather than later looks like a good option.

If you’re keen to get the best value for your money, shop around for the best rates and make sure you do so in plenty of time. Leaving currency exchange until the last minute (such as at the airport) is a surefire way to lose value for your money.

For many families in Britain, the prospect of Christmas goes beyond spending quality time with family; it’s also very expensive.

When you consider the accumulative cost of food, drinks, cards and decorations, it’s easy to see why many people quickly find themselves in debt by the turn of the new year. That’s not to mention the price of those ‘must-have’ presents, which seems to be on the rise every year.

Not to worry – Evolution Money is here to help!

The words ‘festive’ and ‘frugal’ are rarely used in the same sentence, but that’s not to say it’s impossible to enjoy the benefits of a budgeted Christmas. Here are our top five tips to save yourself money throughout the festive period…

-

Start saving from Halloween (or before!)

Those who rely solely on December’s payslip to fund their entire Christmas splurge are definitely asking for trouble.

If you want to go all out without sacrificing too many beloved frills then it always pays to get ahead with your Christmas shopping. Buy and stash what you can in November (or even October) in order to split the cost between two or three pay packets.

-

Agree your limits

As the conversation with friends, family and work colleagues turns towards the upcoming Christmas break, start planting the seed of expectation. For example, many couples with children choose to operate a ‘kids only’ rule – or at least set a fairly modest limit to spend on each other.

Secret Santa doesn’t have to be the sole preserve of the workplace either; if you’re lucky enough to have a sizeable group of friends then this can cut down the cost of getting gifts for everyone. And rather than picking up a bog-standard £20 book from the Waterstones bestseller list, get creative with £5!

Remember, it really is the thought that counts.

-

Gather your vouchers

Thinking of a perfect time to use all those Tesco Clubcard or Sainsbury’s Nectar points that you’ve accrued throughout the year? Christmas is it.

For many loyalty schemes, it pays off to convert your points into vouchers first instead of simply cashing them all in at the till in one go. These vouchers are ideal to compensate for the extra money that every family is likely to spend on all that lovely food and drink.

-

Choose your supermarket wisely

While you may not think twice about shopping at Tesco, Asda or Sainsbury’s for the rest of the year, have you ever stepped foot into Lidl or Aldi? For quality fruit, veg and meat produce, the price difference can be quite remarkable. That includes turkey!

Although all supermarkets will literally be teeming with special offers in the build up to Christmas, it’s probably best off to give Waitrose or M&S a miss if you’re looking to keep your shopping bill down.

-

The end of year clearout

While you’re already up in the loft pulling down bags full of tinsel and old decorations, take note of what items you may be prepared to part with: clothes, electronics equipment, that old telescope that hasn’t been used since 2006.

It’s no secret that websites like eBay are a prime market for selling on your unwanted goods. Once you get into the habit of uploading your listings (which can now be done quickly on your mobile phone) it could even become a fairly regular source of extra cash.

Contrary to popular belief, it seems that the British economy isn’t performing too badly since the results of the EU referendum were announced back in June.

In fact, official figures released this week show that our economy is growing at a faster rate than many experts had predicted at this stage of the year. Third quarter growth currently stands at +0.5%, nearly double the +0.3% majority forecast.

Which industries are contributing to this growth?

By far the most dominant sector, the services sector – which includes transport, storage and communications – grew by +0.8% in the third quarter.

However, this is largely isolated growth that compensates for the fact that nearly all other major sectors shrank in Q3. As expected, construction fell sharply by -1.4%as we enter the winter season, while manufacturing and agriculture also contracted.

Although no official figures have been released on consumer spending, it’s highly likely that incredibly low interest rates and a weakened pound went some way to encourage overseas spending and investment for UK goods and services.

So, was Brexit the right call?

It’s still far too early to tell. Both ‘Leave’ and ‘Remain’ voters will argue that these findings support their respective points of view.

Of course, Brexit supporters are likely to view these figures as a sign that any warnings about a potential economic downturn were largely unfounded, and that Britain is in fact, benefitting from the decision to leave the EU.

However, those who voted to remain in the EU would argue that it is the drastic action taken by the Bank of England to encourage spending that has salvaged economic growth – and that any promises of sustained growth will soon be dampened as we enter 2017.

For the time being, both opinions are somewhat speculative and, given the fact that many economic experts failed to predict the current level of growth, we still cannot be sure of either the long-term or the short-term impact economic consequences of the Brexit vote.

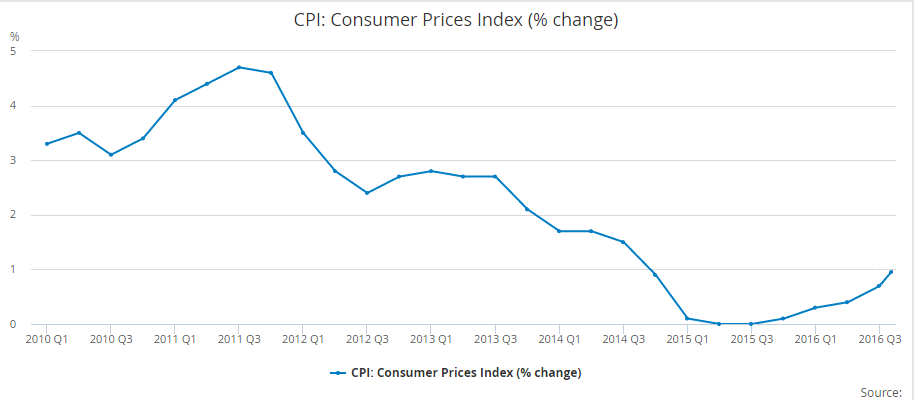

UK inflation rose to 1% in September, up from the 0.6% rate reported in August. The figures, released this week by the Office of National Statistics (ONS), also show that we’re currently at our highest annual rate of inflation since 2014.

Inflation explained

The ONS measures inflation using the Consumer Price Index (CPI), which is basically the rate at which the average shopping basket has increased or decreased over the past year. This basket includes goods and services such as food, housing, clothing, transportation, education and medical care, to name a few.

Right now, the cost of the average shopping basket is rising at a faster rate than we’ve seen in recent years. But bear in mind that, historically, our current level of inflation remains very low, especially when compared to the heights of 5% in 2011. This could indicate there’s still room for inflation to increase further in the coming year.

The below graph shows the trend of UK inflation over the past six years.

What exactly is causing the current rise?

If we take a closer look at our average shopping basket, there are a few notable contributors. Clothing and footwear prices have jumped up, as is the norm around the winter months, while the cost of fuel, hotels and restaurants has also increased. Governor of the Bank of England, Mark Carney, predicts food prices will soon rise too.

Experts say that the falling value of the pound – down by 18% against the dollar since Brexit – hasn’t had a major impact on inflation yet, though it is likely that this impact will push prices up further before too long.

Unfortunately, they also predict that poorer families will be hit hardest by the rise, due mainly to the fact that benefits are frozen at the moment and will not rise in line with CPI. As a result, these families will lose a bigger portion of their disposable income, as much as £100 per year according to the Institute for Fiscal Studies.

The average house buyer in the UK now requires six times the amount of their yearly income to secure a home, according to latest official figures from the Office of National Statistics (ONS).

This confirms that house prices have risen at a far quicker rate than average earnings over the past decade. In fact, the ONS found that house prices have risen by as much as 88% – from £110,000 in 2002, to £207,500 in 2015. Compare that to average earnings increase during the same period – £26,000 in 2002, to £32,780 in 2015.

It’s easy to see the disparity between these two sets of growth, but it’s also worth bearing in mind the two ends of this spectrum because the average figures alone don’t quite tell the whole story.

The most and least affordable places to live in the UK

The ONS data actually showed that in a third of local authorities across the country, house prices had actually reached more than 10 times salary earnings, with the biggest gaps unsurprisingly found in London and the south-east.

Regional differences show that Burnley is the most affordable place to live in the UK; whereas Westminster ranks as the least affordable. The median house price in Burnley is a mere 3.6 times the median salary, compared to 23 times the median salary in Westminster.

The ONS report is perhaps our most recent evidence that the North/South divide is still very much in effect in the housing market.

Tough times for all buyers, not just first-timers

The theme of first-time buyers struggling to secure their first step on the property ladder is well-known. It’s now becoming more and more obvious that homeowners and renters across the country are losing a bigger slice of their income to the cost of accommodation, particularly those on the move.

And although there has been some movement from the government to increase housing provision throughout the country, many experts maintain that the UK is still far off the number of houses needed to make housing as affordable as it was ten years ago.

It’s 1966. Families nationwide crowd around tiny television sets to watch Bobby Moore lift the World Cup for England at Wembley.

James Callaghan, Chancellor of the Exchequer, declares his intention to shift to decimalisation of the pound in five years’ time. Beatlemania is in full swing, and the song ‘Taxman’ on their latest album Revolver complains of high marginal rates of up to 95%.

British MPs debate the prospect of joining the European Union (then known as the European Economic Committee), approximately 50 years before debating an eventual exit.

Personal finances were also remarkably different compared with those of today. The average weekly wage, usually paid in cash on a Friday, was between £20–£27 whilst the average house price was around £3,620. It was a different world, financially and otherwise.

Changing attitudes and added complication

The way people approached their weekly budget was remarkably different, particularly the propensity to save which was far greater than today’s standards. Back in 1966, common practice was to keep a weekly or monthly ledger that showed exactly how much spending was going out against your total income.

The concept of being able to check a bank statement in the palm of your hand was inconceivable. And in a world without ATMs and online banking, a ledger was absolutely essential to tot up your total outgoings. In many ways this made the general public of 50 years ago far more frugal with their spending.

Now that we have the ability to check our bank balance at a moment’s notice, the need to meticulously run through your family budget each week, or even withdraw a precise amount of money for the week ahead, has certainly lessened.

Tending more to spend

On the whole, today’s generation have become more cavalier with their weekly expenditure. This uplift in spending is also due to the massive development of products and services that we’ve experienced in the latter 20th century. Thousands of new household ‘essentials’ have been introduced to the masses in that time – colour TV, fridge freezers, vacuum cleaners, broadband, the list goes on.

Saving has given way to spending because we have so many more options and incentives to consider, coupled with our ability to pay for anything with a piece of plastic. Personal finance was a different ball game back in 1966, and perhaps we can even learn something from the way things used to be.

Evolution Money is a non-LTV lender offering secured loans from £1,000 – £20,000 to clients with zero or restricted equity and mortgage arrears. Read more about our loan service and how we can help you today.

Representative 22.93% APRC variable.

For a typical loan of £26,600 over 180 months with a variable interest rate of 19.56% per annum, your monthly repayments would be £484.00. This includes a Product Fee of £2,660.00 (10% of the loan amount) and a Lending Fee* of £763.00, bringing the total repayable amount to £87,030.00. Annual Interest Rates range between 11.7% to 46.5% (variable). Maximum 50.00% APRC. *Lending Fee varies by country: England & Wales £763, Scotland £1,051, Northern Ireland: £1,736.

Think carefully before securing debts against your home may be repossessed if you do not keep up repayments on your mortgage or any other loan secured against it. If you are thinking of consolidating existing borrowing, you should be aware that you may be extending the terms of the debt and increasing the total amount you repay.