It’s no secret that our gas and electricity bills tend to grow a tad larger during the festive period. Now is the time when friends and family get together, share a mince pie or two and stick on a Christmas film. With the heating on, of course.

But while energy usage inevitably increases, millions of UK residents are now expecting a far more expensive utility bill than usual. Rising wholesale gas and electricity costs, coupled with further green taxes, now mean that the average cost of gas and electric may go up by as much as £100 over the next 12 months.

Why exactly? Well, many large energy suppliers are putting the price hike down to a knock-on effect from Brexit. Raw energy is generally priced in US currency, which makes the pound’s collapse against the dollar particularly significant for large energy providers.

There are quite a few obvious steps you can take to cut down your energy bill over Christmas, most of which are probably common sense and best practice all year round.

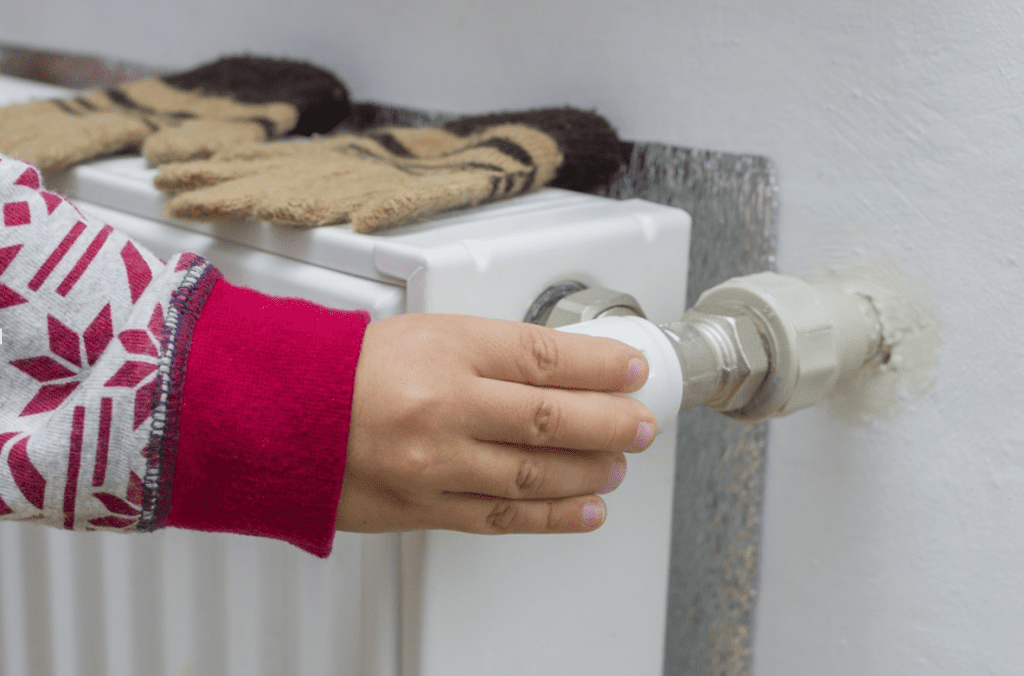

If you or your family are walking around the house in a T-shirt with the heating on, it’s time to heed your father’s advice and invest in a woolly jumper. Of course, if you do decide to turn the heating on when you get home from work, make sure you turn it off once your ideal temperature has been reached. Keep doors and windows closed to keep the warmth in. A draft excluder always helps.

The same goes for lights – switch them off when you leave a room! Energy saving bulbs are well worth the investment and can cut down on cost over the course of months and years.

As for Christmas lights, perhaps it’s best to set a limit for when you turn them on each evening. A few hours here and there is certainly better for your budget than leaving them running all night long, which can also be a major safety hazard.

Evolution Money wishes you a very Merry Christmas, and a Happy New Year!

Representative 22.93% APRC variable.

For a typical loan of £26,600 over 180 months with a variable interest rate of 19.56% per annum, your monthly repayments would be £484.00. This includes a Product Fee of £2,660.00 (10% of the loan amount) and a Lending Fee* of £763.00, bringing the total repayable amount to £87,030.00. Annual Interest Rates range between 11.7% to 46.5% (variable). Maximum 50.00% APRC. *Lending Fee varies by country: England & Wales £763, Scotland £1,051, Northern Ireland: £1,736.

Think carefully before securing debts against your home may be repossessed if you do not keep up repayments on your mortgage or any other loan secured against it. If you are thinking of consolidating existing borrowing, you should be aware that you may be extending the terms of the debt and increasing the total amount you repay.